- Details

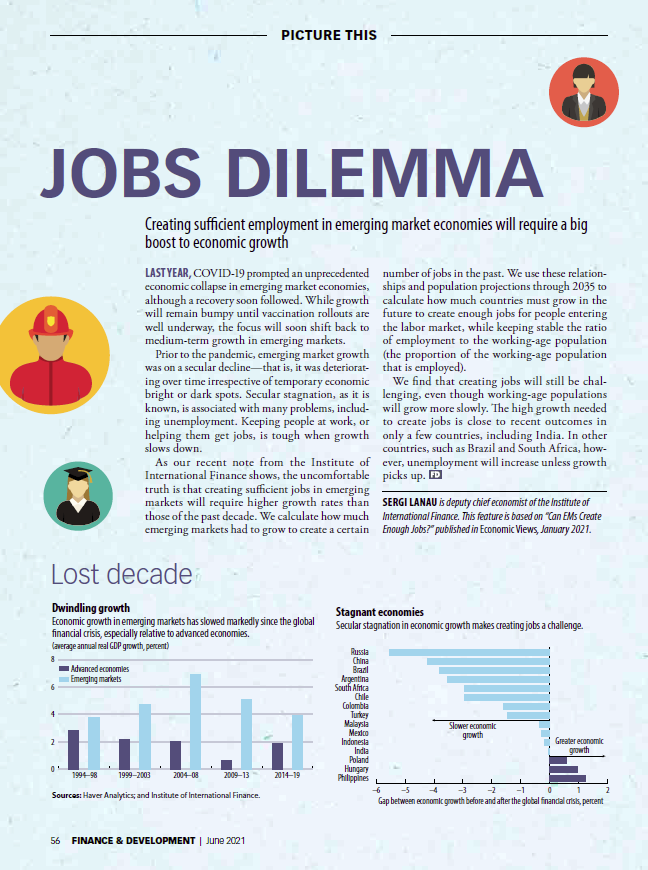

The new article in the IMF's Finance&Development magazine discusses the topic of employment and key preconditions to continue creation of jobs. according to the authors, "creating sufficient jobs in emerging markets will require higher growth rates than those of the past decade". The article contains few graphs that demonstrate the state of employment and jobs in various economies across the world.

- Details

This report presents findings from a survey on green finance conducted among 1 000 households in the Kyrgyz Republic (Kyrgyzstan) in 2019. Although green finance is an emerging trend, knowledge about the appetite for green financial products and services in Kyrgyzstan is almost inexistent. The OECD prepared the household survey to close this gap in evidence. The research identified needs and demand from existing and potential clients of Kyrgyz financial institutions for financial instruments, including those that promote sustainable development.

Read more … Accessing and Using Green Finance in the Kyrgyz Republic

- Details

Artificial intelligence technologies are permeating financial services sectors around the world. The application of these technologies in emerging markets allows financial service providers to further automate their business processes and to leverage new and big data sources to overcome obstacles, including the high cost of serving rural and low-income customers and establishing customer identity and creditworthiness,

Read more … Artificial Intelligence Innovation in Financial Services

- Details

"From Sub-Saharan Africa to the Indian Subcontinent, asset finance and leasing companies are doing invaluable, innovative work to finance critical assets for low-income and informal borrowers. But unlike banks and microfinance institutions, many of these companies do not have deep experience in organizing a credit operation, mitigating risk throughout a credit transaction or managing a portfolio of loans or leases. This has important implications for the ability of asset finance companies (AFCs) to achieve financial sustainability: poor credit risk management will prevent them from turning receivables into cash, inhibiting their potential scale."

Read more … Getting Repaid in Asset Finance: A Guide to Managing Credit Risk

- Details

"Economic prospects have diverged further across countries since the April 2021 World Economic Outlook (WEO) forecast. Vaccine access has emerged as the principal fault line along which the global recovery splits into two blocs: those that can look forward to further normalization of activity later this year (almost all advanced economies) and those that will still face resurgent infections and rising COVID death tolls. The recovery, however, is not assured even in countries where infections are currently very low so long as the virus circulates elsewhere.

- Details

In this EBRD working paper authors discuss "the relationship between quarterly estimates of economic activity and people's mobility during the Covid-19 crisis in a sample of 53 economies."

"Social distancing aimed at containing the spread of the Covid-19 has constrained both demand and supply across economies resulting in the greatest disruption to global economic activity since the Second World War. The drop in people’s movements relative to the normal state of the economy has been a good predictor of economic activity since the early months of the crisis.

Read more … Mobility and economic activity around the world during the Covid-19 crisis

- Details

The EBRD Annual Review 2020 "describes the impact of the EBRD’s investments, projects and policy work amid the Covid-19 crisis, and outlines our achievements in key sectors and initiatives." Investments made by the EBRD in 2020 totaled "a record €11 billion through 411 projects, responding to the effects of the pandemic and preparing for recovery."

- Details

This joint ADB and World Bank publication analyses climate change risks in the Kyrgyz Republic and intends to guide policy dialogue to mitigate climate change risks in the country.

Among key messages, the publication puts emphasis on significant air temperature rise, which is projected to be above the global average and changes in both maximum and minimum extremes. Another significant area of risk concern is water resources. Potential loss of glaciers may result in the irregularity of water flow, potential floods and droughts.

- Details

"When interest rates are high and inflation is low, investing is a cinch: savers can earn easy returns by simply parking their funds in Treasury bills or similar safe assets. But it becomes much harder when interest rates are low, as they have been in most advanced economies since the global financial crisis of 2008–09 and in some of them for longer still. Fed up with zero or near-zero interest rates, savers may be tempted to experiment with riskier assets or strategies in the hope of higher returns. Economists call this the search for yield.

Read more … Back to Basics: Risk and Return: the Search for Yield

- Details

IFC has published a diagnostic report about Kyrgyzstan's private sector. The report "assesses the barriers and opportunities for a more forceful development of the private sector in the country. With the conviction that higher and more sustainable economic growth can be achieved by enhancing the role of the private sector in the Kyrgyz economy, this CPSD identifies policy reforms needed to increase private investment and create market opportunities in sectors that may enable, accelerate, and diversify economic growth."

Read more … Creating Markets in Kyrgyz Republic: Country Private Sector Diagnostic

- Details

ADB has published a new book on Financing Clean Energy in Developing Asia. "It reviews existing financing options and approaches for clean energy, and includes country examples of how these have been applied. Innovative solutions for mobilizing private finance and managing risks associated with clean energy investments are also discussed.

- Details

This publication by ADB Institute examines how infrastructure impacts firm performance in several CAREC countries: Afghanistan, Azerbaijan, Georgia, Kazakhstan, the Kyrgyz Republic, Mongolia, Pakistan, Tajikistan, and Uzbekistan.

The authors of the publication review power outages, electricity expenses as the share of total sales, access to broadband internet and efficiency of customs compared to firms' total sales, share of utilized capacity, dummy variable if firm exports and the share of export sales.