- Details

"Women, Business and the Law 2021 is the seventh in a series of annual studies measuring the laws and regulations that affect women’s economic opportunity in 190 economies. The project presents eight indicators structured around women’s interactions with the law as they move through their lives and careers: Mobility, Workplace, Pay, Marriage, Parenthood, Entrepreneurship, Assets, and Pension. This year’s report updates all indicators as of October 1, 2020 and builds evidence of the links between legal gender equality and women’s economic inclusion. By examining the economic decisions women make throughout their working lives, as well as the pace of reform over the past 50 years, Women, Business and the Law 2021 makes an important contribution to research and policy discussions about the state of women’s economic empowerment.

- Details

"With the great strides in financial technology in recent years, the lower data processing costs and fees associated with investing in the stock market should have led to broader increases of household wealth. But in this podcast, economist Roxana Mihet says while fintech has reduced barriers to access and held out the promise of gains for all, it may have worsened capital income inequality. Mihet is Assistant Professor of Finance at HEC Lausanne, and her recent study suggests the most likely beneficiaries of financial innovation are those who have access to the valuable data that inform good investments."

Read more … IMF Podcast on Financial Innovation and Rising Inequality

- Details

A lookback on 2020 from Greta Bull, CEO of CGAP with a focus on financial inclusion of micro and small enterprises and digitalisation of financial services.

- Details

This publication by Alliance for Financial Inclusion (AFI)aims to raise discussions on "a first approach on collecting Inclusive Green Finance (IGF)-related data from the demand-side, specifically from Demand-Side Surveys (DSS), to support financial regulators and financial service providers to measure the needs and perspectives of the target populations related to the impact of climate-related events and other IGF policies related to the 4Ps conceptual framework."

Read more … Demand-side Approach to Inclusive Green Finance Data Collection

- Details

"The informal economy, comprising activities that have market value and would add to tax revenue and GDP if they were recorded, is a globally widespread phenomenon. According to the International Labour Organization, about 2 billion workers, or 60 percent of the world’s employed population ages 15 and older, spend at least part of their time in the informal sector. The size of the informal sector slowly decreases as economies develop, but with wide variations across regions and countries."

- Details

The EBRD's new podcast discusses globally rising trends of inequality. "Inequality is emerging as the “biggest policy challenge” during and after the Covid-19 pandemic, with the World Bank estimating that extreme global poverty is to rise for the first time in over 20 years."

Read more … EBRD Podcast: Combatting inequality during and after Covid-19

- Details

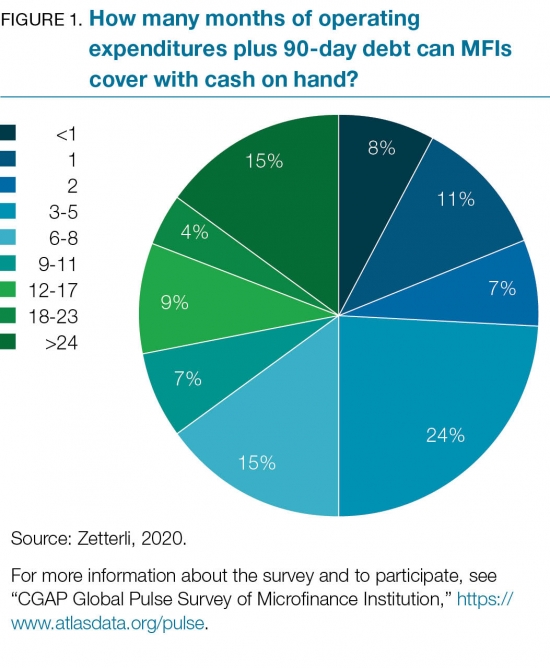

The COVID-19 pandemic is making it harder for people around world to sustain their livelihoods. The microfinance providers (MFPs) who serve low-income individuals and small businesses in emerging markets are bracing to weather this storm; however, moratoria and deteriorating portfolio-at-risk rates are putting their liquidity under pressure. Not surprisingly, some MFPs and funders have found themselves gathering around the negotiating table in search of a response to liquidity challenges and potential solvency concerns.

- Details

New article on ADB's blog about the role of digital technologies in the times of crisis has been published.

"The pandemic has highlighted the power of digital technology. Now is the time to harness this power for inclusive growth so that communities, especially in poor and remote areas, can survive the crisis and thrive."

Read more … Fintech can drive a strong post-COVID-19 recovery in Asia

- Details

"The World Economic Forum’s Future of Jobs Report 2020 comes at a crucial juncture for the world of work. The report, now in its third edition, maps the jobs and skills of the future, tracking the pace of change based on surveys of business leaders and human resource strategists from around the world. This year, we aim to shed light on the effect of pandemic-related disruptions placed in the broader context of longer-term technology trends. Here are the five things you need to know from our findings..."

- Details

"The OECD Economic Outlook is the OECD’s twice-yearly analysis of the major economic trends and prospects for the next two years. Prepared by the OECD Economics Department, the Outlook puts forward a consistent set of projections for output, employment, government spending, prices and current balances based on a review of each member country and of the induced effect on each of them on international developments.

- Details

"The COVID-19 crisis has had a profound impact on SME access to finance. In particular, the sudden drop in revenues created acute liquidity shortages, threatening the survival of many viable businesses. The report documents an increase in demand for bank lending in the first half of 2020, and a steady supply of credit thanks to government interventions. On the other hand, other sources of finance declined, in particular early-stage equity."

Full article can be viewed via the following link.

Source: OECD

- Details

In the 20th episode of EBRD podcasts, participants Peter Pomerantsev, Senior Fellow at LSE and Samuel Woolley, Professor at University of Texas at Austin together with hosts - Jonathan Charles and Kerrie Law - discuss the effects of pandemic and a new state-controlled panopticon, watching citizens and their movements in the name of public safety.

Read more … EBRD PODCAST: Is Technology in the Era of COVID-19 a Threat to Democracy?