The EBRD Business Guide is an online platform for SMEs which employees of financial institutions will find useful when working with SME. The site provides information and resources on how SMEs have resolved challenges, legal information and tools. The resource offers a range of modules and templates on finance, strategy and planning, HR as well as checklists on digitalization, work safety and other.

The platform is accessible at the following address: https://businessguide.ebrd.com/

All material is available in English and, among others, selected material is available in Russian.

Kyrgyzstan Tajikistan Uzbekistan

Day #1

Day #2

The analysis of qualitative indicators in lending to micro, small and medium-sized enterprises is of great importance. It is an essential part of the analysis and as important as collection and analysis of financial results. Moreover, a comprehensive and meaningful analysis of financial indicators is only possible if the current situation of a business and its qualitative characteristics are fully understood.

There have been quite a number of cases where businesses with - in principle - good financial performance did not meet their credit obligations due to irrational decisions taken by owners, disagreements among owners or other internal problems. By analysing only numbers without understanding their origin, their exact meaning, without understanding the business model, its main development milestones, the competence of management, relations between owners, their strategies and business development plans, it is extremely difficult to get a full picture of the potential borrower’s credit capacity and possible risks ...

In view of often extremely limited reliable and confirmed financial information, a qualitative analysis of data is of particular importance for the analysis of micro, small and medium-sized enterprises (MSMEs).

In this article, we discuss the main qualitative factors to be considered when taking lending decisions on MSME clients, we provide examples of risks relating to qualitative criteria, and give recommendations for conducting qualitative analyses.

The main areas of qualitative analysis[1]

The process of qualitative analysis includes a detailed analysis of owners and the management team, the business environment, and internal organization.

The primary goal of the analysis is to understand the client's business, identify potential risks and assess their impact on the client's ability to repay the requested loan amount. However, you should take a broader approach to the analysis of each client and consider the potential for long-term mutually beneficial and profitable co-operation: business development support with the help of existing products, cross-selling of other products and the perspective for successfully catering to most, if not all, financial needs of the client, rather than focusing on a single transaction.

For such an analysis, you typically use information from the loan application, from the documents submitted by the client, information obtained during client meetings and interviews with owners and other individuals involved in the business, information obtained from observations made during client visits and from other available sources, including the Internet.

We take a complex approach to data collection and assessment. The information collected from the different sources can be grouped into blocks. Among other options, collected data can be grouped as follows:

- business background, owners and management, quality of management;

- business organization; risks arising from the business model; business environment and competitors and related potential risks;

- feasibility analysis of the client's loan request, the client's plans and the business development strategy;

- assessment of the likelihood of the business belonging to a group of related entities and the group’s impact on the borrower's business (and vice versa).

In the following, we go through key aspects of analysing each of the above areas, including examples for potential risks.

Business background, owners and management quality

To understand the current business situation and potential threats to successful development, it is useful and recommended to analyse the history of business development: who exactly founded the business and who is managing it? You should clarify the development strategy chosen by owners, the client's plans and the qualification/competence of business managers. It is also necessary to determine the real owner, as in some cases nominal owners may apply for a loan.

Generally, the following aspects should be analysed:

- how the business was founded; start-up capital and its sources;

- business development milestones; the current ownership structure, the level of competence of the management;

- the strategy of owners, development plans, analysis of the business environment;

- ownership with a view of identifying actual owners;

- key persons in the business and their competence in the respective area.

It is important to consider any changes in ownership or main activities over time, especially over the last year, and the main reasons for these changes. In addition, we recommend to check if there are plans for strategic changes (in the composition of owners/key persons, in business activities or geographical coverage, etc.), and to understand the reasons for planning these changes.

Meeting key decision-makers can give you valuable information, since the level of their expertise and competence can significantly affect the development of the business and, accordingly, the ability to repay the requested loan on time.

It is important to consider the sources of start-up capital as well as whether there is access to additional funding for business development if needed – to be provided either by owners or through alternative sources. For legal entities, it is worth paying attention to paid-up authorized capital rather than only the authorized capital indicated in founding documents as this may not yet have been fully paid in.

It is important to pay attention to the owners’ experience, character, the purpose of creating the business, the main business development plans, both short-term and long-term.

Most of the information for analyzing these factors can be retrieved during interviews with the management team and business owners. In the process of the analysis, we recommend to compare verbal information with statutory documents presented by the client and historical results as documented in the financial statements for previous periods.

For reference, the table below outlines possible risks in this area.

|

Examples of risks associated with business owners and governance |

|

|

|

|

|

|

|

|

|

|

Internal risks associated with business management and ownership structure are quite common, so it is important to pay due attention to the analysis of the factors described above. Their critical assessment helps you to identify weaknesses in the management system and thus identify potential risks for your financial institution. You should bear in mind that one client may be exposed to several of the above risks.

Business organization: risks associated with the business model

In addition, we recommend to analyse the organizational details of the operations of a potential client, the client’s relations with major customers and suppliers, the level of staff qualification and other aspects of the business model. The main factors to be considered at this stage are:

- Dependence on certain suppliers (supplier concentration), main terms of cooperation;

- Dependence on certain customers (customer concentration) and who is responsible for client acquisition;

- How well-established sales channels are;

- Staff turnover, labour shortages;

- Risk of business interruptions; risk that business operations may be temporarily suspended or stopped completely

- Internal control over the business.

Risks arising from the respective business model are inherent business risks, regardless of business size and experience. Therefore, when analysing a loan application, we recommend to try to fully understand how the client's business is organized. Understanding the business model is the basis for identifying and assessing potentially existing risks.

The table below presents a short list of potential risks associated with the business model:

|

Examples of risks associated with the business model |

|

|

|

|

|

|

|

|

|

|

|

|

For customers operating in sectors such as manufacturing and transportation, the following risk factors may be of particular relevance: improper equipment maintenance leading to breakdowns; dependence on narrowly specialized staff; licensing problems; fixed asset registration to third parties; high workplace injury risks, fire hazardous production process.

It is necessary to carefully analyse business organization, the owners’ awareness of potential risks and the measures they can realistically take to reduce them.

Feasibility analysis of the client's loan request, the client's business development plans and strategy

One of the most important parts of any qualitative business analysis for the purposes of loan decision-making is the analysis of the feasibility of the client's loan request (loan application). First, it is necessary to have a clear understanding of the purpose of the loan requested: will it be used for the needs of an existing business, to expand an existing business, to develop a new business line, to penetrate a new market or start a completely new business.

However, for a feasibility analysis of the requested loan, it is not enough just to note down the client's request and clarify what exactly the funds will be invested in. It is important to understand what goal the client is pursuing with the requested funding, what (s)he plans to achieve, why (s)he decided to apply for a loan, how exactly the loan will affect business performance. It is also necessary to carefully analyse the grounds for these expectations of the client, assess their feasibility and the time frame for project completion/full implementation of the project.

An interview with the owner and/or management of the business is the main source of information for this analysis, supported by documentation confirming that the request is financially sound (issued bills, business plans, assessment of investments in construction and renovation, Internet research to verify data provided by the client, etc.).

Depending on the loan purpose, you need to pay attention to various factors.

Request for a working capital loan

In general, working capital loans tend to be less risky than investment loans for the purchase of property, production plants, and equipment. Nevertheless, the loan officer/client relationship manager must carefully assess the main reasons for requesting additional working capital financing.

Once the loan officer/client relationship manager has identified what exactly the client is requesting, (s)he must take a closer look at what really prompted the application. If the purpose of requesting a working capital loan is to increase production or replenish inventory to meet increased demand, then the request seems reasonable. However, it is necessary to cross-check the client's calculations and the availability of sufficient resources, premises and potential demand, to make sure that increasing production volumes is feasible and necessary. If the loan officer/client relationship manager finds that the client does not yet have the necessary additional resources, (s)he must check if the client has a clear plan for acquiring the necessary resources (hire and train additional employees, find extra premises, conduct an additional advertising campaign) and a realistic time frame for implementing these plans.

If the client is requesting financing for the purchase of additional inventory that is noticeably different from normal inventory levels, you should pay particular attention to the reasons for the request and make sure there are no potential problems behind this. It is important to check the client's capacity to achieve the planned increase in sales, the client’s warehousing capacity to store larger volumes of inventory, the feasibility of forecasts, to verify what measures were already implemented with what result and whether the client's expectations are/can be met.

Fixed asset financing

Fixed asset financing can be requested by an existing business to replace existing assets or for business expansion: introduction of a new product/service or opening new business locations / entering new markets, opening a new business line or starting a completely new business. It is important to understand the reasons for investing and carefully analyse the loan purpose, since the cost of such investments is usually high and payback periods are long. Investments in fixed assets can affect a client's existing business in different ways, and impact can quantitative and qualitative.

Quantitative effects usually involve an increase in production, sales, net profit, equity, reduced operating costs (maintenance, labour, rental costs) or increased operating costs - if additional staff is needed.

Qualitative effects usually involve an improved competitive position in the market, an increased share in an existing market, improved product quality or reduced environmental pollution.

In any case, it is important to double-check the client's expectations, question the forecasts and check them against own market research and main trends in the sector.

Employees of the financial institution must evaluate the entire business plan of the client, and not just the part that will be financed by the requested loan. Among other things, it is important to determine the investment and repayment deadlines and sources. The investment plan of a business must be assessed in a comprehensive manner, and it must be demonstrable that there are sufficient resources (including time, labour, expertise) for its implementation, that expected results are reasonable, not inflated, and that the business will actually benefit from financing.

Having analysed a given business plan you will not only understand the loan purpose, but also all impact (direct and indirect) on the client's business in the short- and long-term. In conjunction with this you should also analyse the owners' business development plans and compare whether the current request for financing is logical in the context of the chosen development strategy.

Development plans and strategy

In general, it is extremely important to analyze the plans of a client in MSME finance. It is not uncommon for the MSME sector that a profitable business may deteriorate due to irrational decisions made by owner(s) or overly ambitious development plans.

You should assess the attitude of the business owners to business development: do they plan to develop the business only at the expense of their own funds, or are they applying for more and more loans every year? Are profits reinvested in the business, withdrawn completely or invested in other areas? Do owners prefer stability or focus on aggressive growth and market capture?

For financial institutions, the risk level largely depends on the business owner’s style of decision-making about changes in the business: how carefully does the owner approach these decisions? Does the owner conduct adequate preliminary analysis? Does (s)he prepare for remedial measures in response to possible negative scenarios in advance or are his/her decisions spontaneous?

It is also advisable to check the targeted and actual use as well as conditions of earlier loans. The fulfilment/non-fulfilment of the terms and conditions for earlier loans is an additional sign of the potential borrower’s organized nature, diligence, and good faith. In addition, the client’s past behaviour can help assess his/her qualities as a leader, a successful entrepreneur, a quality manager who really can competently create and implement plans, including resolving obstacles that may arise during plan implementation.

Assessing the likelihood of a business belonging to a group of related entities and the group’s impact on the borrower's business

As a separate aspect of the analysis, it is worth mentioning the analysis of the likelihood of the borrower’s relation/connection to a group of related entities and the group’s impact on the borrower’s business results (and occasionally vice versa). If a business owner has a parallel business (or businesses), the sources of potential risks increase and the overall risk profile may change, since there may be counter-flows of goods and money between connected entities (both regular, easily traceable, and irregular, unsystematic).

The financial situation of connected entities can be stable, or it can deteriorate and require significant investments, so that owners may withdraw funds from one business to stabilize another business, thus weakening the financial position of the first business. In addition, any related business may be exposed to the different risks described in this article, which may negatively affect the performance of the entire group.

Regardless of a thorough analysis of the borrower as a stand-alone business, financial institutions will often not have all information needed to fully assess risks without an analysis of the group of connected entities. In practice, various tools are used when financing such clients, taking into account the possibility of additional sources of potential risks. The main tools involve mitigation of potential risks by requesting additional or harder collateral, using a higher collateral coverage ratio and/or consolidation of the group's financial results to assess existing risks.

Consolidation of the results of a group of connected entities for a more informed decision (when appropriate for a given segment) means analysing the financial results of all related businesses. Thus, you can assess the entire range of risks, as well as identify all potential needs for additional resources. [2]

For segments or cases where fully-fledged data consolidation of connected entities is not economically justified (the work and trouble involved is too high if compared to loan amount, possible profit etc.), it is advisable at least to analyse the existing connections in the group to a level that makes it possible to understand the main interrelations, measure and foresee/eliminate the main risks associated with the group. For such situations, the requirements for loan security are usually higher (including the possibility of additional disbursement preconditions and provision of additional guarantees) than in the case of a fully transparent group of entities.

How can we determine if a potential borrower belongs to a group of connected entities? You should pay attention to indirect evidence. The table below outlines basic examples.

|

Examples of evidence/red flags signaling the possibility of connected entities |

|

|

|

|

|

|

|

|

In Central Asia, groups of connected entities and operating businesses in parallel in the SME segment are quite common. Identifying related individuals is critical to assessing the risks associated with the group and making an informed decision. Therefore, such information should be double-checked with due care.

The list of qualitative analysis factors can be continued, including the cross-checking of information provided, of the declared scope of activities etc. In this publication, we cover the most significant factors, and their detailed analysis will allow us to come to a comprehensive understanding of the client's creditworthiness and the factors that can have an impact on it.

It is important to remember that the presence of any of the listed potential risks does not mean that you need to stop working on an application in hand and refuse the client. Identifying a particular risk means that when making a loan decision, you should consider the potential impact of this risk on the client's solvency and business, including overall future of the business. Additionally it means, that it should be evaluated the optimal financing format given the identified risks and the possible ways to mitigate these risks, including taking additional loan security. In some cases, risks may be such that – even if additional loan security would be available – it is advisable to refrain from lending.

Considering the business, its potential and existing risks you can arrive at a sound lending decision. To build a long-term relationship, we also recommend to discuss the situation with the client, highlight the identified problematic aspects and, if the client asks for it, provide him/her with suggestions on possible solutions.

What is important to consider when conducting a qualitative analysis?

Further recommendations for conducting a quality analysis

The main objectives of a quality analysis:

- cross-check the provided financial results based on an understanding of the client's business organization and its main business processes;

- assess financial sustainability and factors that can affect the performance of the potential borrower’s business, including the ability to adapt to a changing environment, plan business updates in accordance with sector trends;

- analyse the situation in the sector, key economic indicators and trends;

- assess how critical the identified qualitative risks are and how they can affect the repayment of the requested loan;

- analyse the arguments for accepting these risks and formulating additional conditions for mitigating them;

- formulate your conclusions for decision-makers.

We recommend to include space in the analytical forms for the description of main findings regarding identified qualitative risks, foreseeing a different area for each of the qualitative analysis aspects.

For successful implementation of the analysis of qualitative factors in the process of decision making, it is important to pay close attention to the risks identified and to the findings/conclusions drawn as a result of such an analysis.

We recommend to make the qualitative analysis part of the methodology, to structure the approach, and determine the method of documenting the findings of the analysis. Qualitative factors serve as basis for understanding quantitative indicators as well as basis for their correct interpretation and cross-checking, and are critical for sound risk assessment and decision making. The inclusion of qualitative factors in the analysis, along with quantitative indicators, will allow your financial institution to conduct a comprehensive analysis of borrowers and make informed and sound lending decisions.

[1] This topic requires special attention, and a separate online course has been devoted to it on this online platform – “OL2001 Online Course: Data consolidation and relationship between financial statements in SME finance”.

[2] In view of the negative consequences of Covid-19 for economies, additional factors should be considered in analyses, such as, for example, decision-making flexibility and speed with which steps aimed at business optimization can be implemented. These are described in detail in the publication “ANALYZING BUSINESSES IN TIMES OF CRISIS”.

In addition to traditional loans, leasing should be considered as a strategic tool to finance micro, small and medium-sized enterprises (MSMEs). Although it is a well-known instrument for financing the acquisition of all types of equipment in countries around the world, in emerging markets, it is generally more accessible to larger companies than to MSMEs. This paper lays out a number of strategies and recommendations that leasing companies and other investors should follow in order to implement policies and procedures conducive to growing access to finance for MSMEs by means of leasing.

Definition

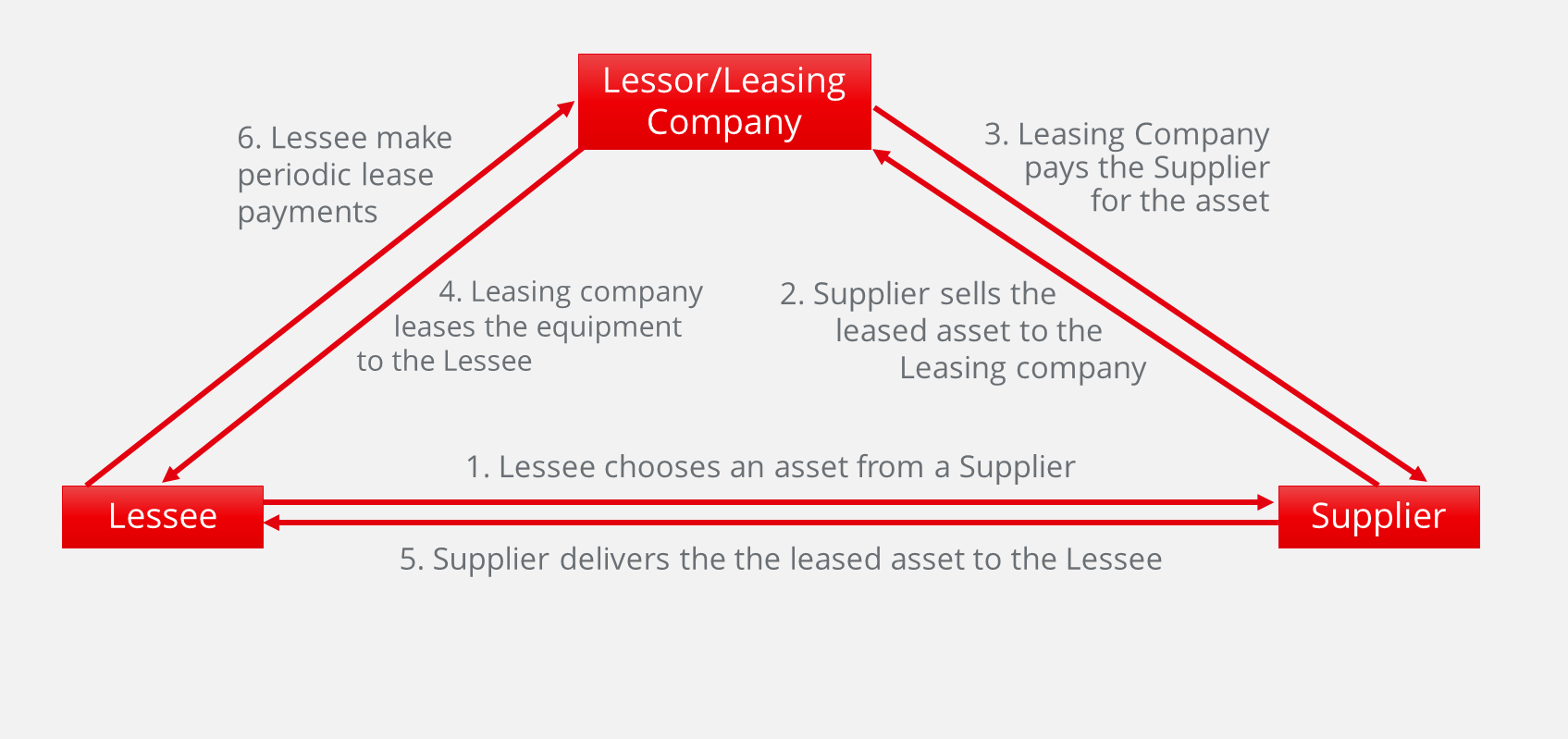

A lease agreement is a transaction whereby one entity, a lessor, leases a defined asset to a lessee. Depending on the country and its specific legislation, a lease agreement may include a third party, the supplier of the leased asset. Please note that the definition of leasing generally varies from country to country, depending on a country’s legal framework, which may include a civil code, leasing laws, and banking regulations.

The approach used to sell leasing services also differs from country to country, depending on the level of development of the financial systems, access to information on potential lessees (through credit bureaus) and the role of the informal economy. Even within one country, the approach may differ depending on the type of leased asset (for example, leasing an aircraft requires a different approach than, for example, leasing a fleet of vehicles).

For the purposes of this paper, we will focus mainly on assets that are suitable for MSMEs (an aircraft is usually not such an asset) and on the general approach to managing all aspects of leasing to this segment.

Typical Structure of a Leasing Transaction

From a macroeconomic perspective, leasing is an important source of additional finance that fills the void for small businesses with limited or no access to bank finance and can be a powerful employment engine.

For financial institutions, due to the relatively strong security provided by the right of ownership, leasing gives them access to a segment of the market that may appear to be riskier, but has the potential to generate higher margins.

Characteristics of Leasing to MSMEs

Here is a quick reminder of the general characteristics of MSME clients:

- Limited access to bank financing.

- Aggressive tax optimisation strategies.

- Dependence on a few key assets to generate income.

- Minimal back-office support for collecting documents and filling out application forms for leasing companies.

Because of the above-mentioned characteristics, MSMEs are much less interested in a strict definition of leasing. They often do not care about the difference between a lease or a loan, and they rarely benefit from any tax advantages. What they really care about is the ease of receiving a new productive asset at an “affordable” price.

As a result, leasing products that are suitable for MSMEs must:

- be simple, and ideally easier to get, or at least no more difficult to apply for than a traditional loan

- take into account the actual revenue and income generating possibilities of MSMEs (including future income)

- be a means of offering entrepreneurs a new productive asset (or a used asset) as quickly and efficiently as possible

Remember that some MSMEs already have some access to financial products based on pure credit risk: these are conventional loans, either to the owner-operators of the businesses or to the businesses themselves. This is why a leasing product should be less focused on credit risk and more focused on asset risk and supplier risk, in order to carve out a more sustainable niche.

As shown in the table below, the general approach to risk management usually depends on the liquidity of the asset and a client's exposure.

Table 1: Risk management focus depends on asset type and total exposure to a client

|

Exposure |

Equipment |

Transportation |

|

> USD 1 million |

Focus: Credit Risk |

Focus: Credit Risk |

|

USD 500,000 to 1 million |

Focus: Credit Risk |

Focus: Mixed approach; the key factor is the liquidity of assets (for instance, 4 Volvo trucks are less risky as compared to one large crane with a value of USD 500,000) |

|

USD 100,000 – 500,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

USD 50,000 – 100,000 |

Focus: Mixed approach; the key factor is the liquidity of the leased asset |

Focus: Asset risk |

|

< USD 50,000 |

Focus: Asset risk |

Focus: Asset risk |

For leasing transactions where the focus is on asset risk, a leasing company can minimise customer credit analysis because the credit risk is less important. Remember that the longer and more complex the credit analysis, the less competitive the leasing product.

Small-Ticket Leasing

In general, any lease for less than USD 100,000 can be considered a “small-ticket lease”. Usually these are vehicles, construction equipment, medical equipment and office equipment.

To be as efficient as possible, it is important to apply the following principles:

- Base your analysis on the asset risk.

- Develop internal scoring and segmentation tools to quickly set pricing and approve applications (same day approvals are ideal).

- Always tie financing to the acquisition of a specific asset. Do not provide a client with a funding quote (with an estimate of the interest rate) without an asset. Insist that the prospective client selects a product (ideally from a supplier partner) and then provide a quote that focuses on the monthly payments for that particular asset.

- Banks can expand their potential customer base. Banks that specialise in lending to MSMEs usually do not work with large companies because they do not take micro or small loans. On the other hand, these large companies are often interested in leasing low-value assets. Thus, small-ticket leasing can open up a new sales channel and generate additional income (through commissions and deposits) from large companies.

- It is necessary to constantly work on efficiency to reduce transaction costs and increase the profitability of the product.

Due to the relatively low value of each transaction, the actual risk of a single mistake is quite low. Therefore, it is important to keep in mind the need to have a diversified portfolio when developing risk models. Likewise, due to the relatively small contribution of each transaction to gross profit, one of the keys to profitability is to develop procedures and policies that focus on the efficiency aspects of operations. This starts with marketing and continues through to documentation requirements, processing times, and approval processes.

Sales and Marketing of Leasing to MSMEs

If you are a bank:

- Understand how leasing may be impacted by your existing credit business. If you are a financial institution and have a strong MSME lending business with aggressive growth goals, it will be difficult to motivate loan officers to promote a new product that they are less familiar with. The classic loan products generate commissions and bonuses for managers and loan officers.

- Remember that your lending procedures and processes are already well developed, so mastering the procedures for a new leasing product can take a long time. These new internal procedures will need to be created, tested and revised, if necessary. If combined with the sale and marketing of credit products, it will need time before the leasing operations function as well as the loan operations.

- In most cases, a potential client will be able to apply for both a regular loan and a lease agreement. What will your loan officers suggest? A product they know very well, or a product that they are uncomfortable with and that requires a third party (such as a supplier)? Experience suggests that loan officers, in most cases, will offer a classic loan to a client.

- Ask yourself the following question: is the client really looking for a lease? Or does he just need "financing"?

In the MSME Segment: cross-selling is extremely difficult. While leasing seems to be a logical extension of loan business, numerous nuances make it inefficient to market leasing via the same channels as SME loans.

If you are a leasing company:

When looking at the value proposition from the perspective of a leasing company, one of the key issues to consider is positioning relative to banks offering leasing products. Banks may be viewed as direct or secondary competitors depending on the market. This is important because banks usually have an edge in terms of funding costs and customer relationships.

Therefore, leasing companies are advised to follow, where appropriate, these recommendations when developing and promoting their products:

- Take a more aggressive approach to credit risk as the collateral associated with a lease is generally stronger.

- Specialise in specific assets/industries: better understand resale markets and industry revenue dynamics (including seasonality).

- Forge partnerships with suppliers to share risks and rewards in order to provide more competitive financial offers and/or financing to “higher risk” customers.

Leasing Companies: If you are simply selling a loan that is repackaged and renamed a lease, you better have a good cost of funding, otherwise your margins won’t be any good! The bottom line is that if you are using “banking procedures” without a bank’s cost of funding, it is very difficult to generate and maintain long-term profitability.

Marketing

Mass marketing of leasing is generally a waste of money. If a potential customer is not planning to purchase an asset, he/she does not need leasing. The most effective sales channel is usually via suppliers.

The supplier-partners are the true “clients”. The lessees are the “consumers”!

When it comes to the value proposition, suppliers generally want quick approvals and a high degree of positive decisions. They care less about the price! As stated earlier, most independent leasing companies want to avoid direct price comparisons and competition with banks, as banks tend to have a cost of funding advantage. Therefore, instead of simply selling an interest rate to a potential lessee, it is important to focus on those non-price qualities that are most valuable or important to suppliers.

Another important point to remember about small-ticket leasing:

- For lessees, the lower the cost of the leased asset, the less sensitive they are to higher rates, and the more willing they are to “pay” for fast service!

The most effective marketing tool – a recommendation from a supplier partner!

Risk Components of Leasing Transactions

Leasing has the following three types of risks:

- Credit Risk

- Asset Risk

- Supplier Risk

Credit Risk

As stated earlier, due to the complexity of leasing as compared to traditional lending, leasing companies and professionals need to be more flexible about credit risk, but better understand the risks associated with assets and suppliers.

The general approach depends on the amount at risk (client exposure) and asset liquidity. In principle, the credit risk of a lease agreement is lower than for a loan. In order to further lower the risk of a transaction, especially if the client has a sub-optimal rating, is to put an increased focus on asset risk. One of the main risk management tools used by leasing companies to enhance the strength of asset risk coverage is via advance payment. In principle, the higher the credit risk, the larger the advance payment should be.

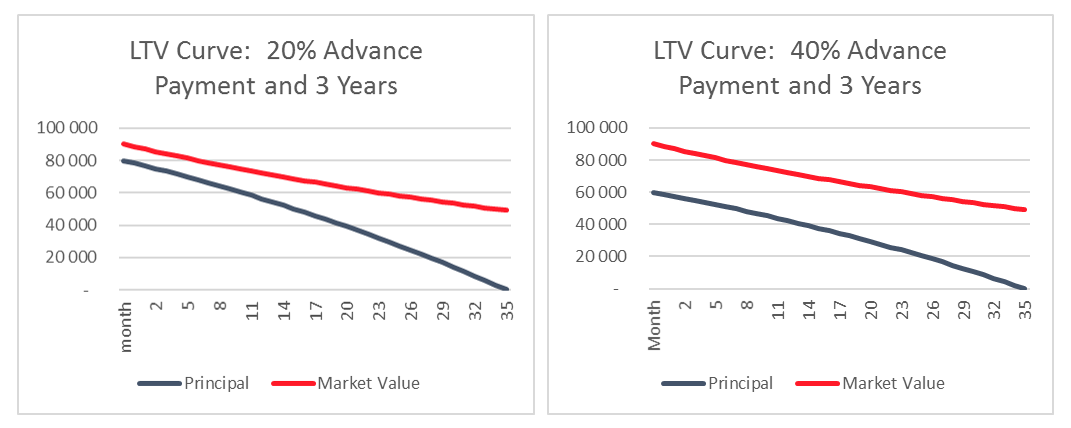

The influence of differing advance payments for risk coverage:

In the graph above, we can compare the curves for two leases with two different advance payments. As we can see, a significant reduction in risk occurs with a larger advance payment.

While the coverage of risks (asset value/lease debt) on the first day of a lease with a 20% prepayment is about 112%, for a transaction with a 40% prepayment, the coverage is 150%. This risk coverage only increases over the lease term, offering the lessor an even higher level of comfort.

|

Key Issues to remember when analysing and structuring lease deals for MSME |

→ Remember: for small-ticket leasing, it must be easier to get a lease than a loan! Otherwise, it will be difficult for the leasing company to compete against more aggressive banks. |

Scoring and Segmentation Models for MSME

In developing markets, there are a number of reasons why the utilisation of complex scoring models is difficult, these include:

- MSME legal entities tend to open and close at a high rate, therefore, these legal entities often lack long-term financial track records.

- The de-jure owner of an MSME is often different from the de-facto owner.

- Credit bureaus will often only maintain credit histories on individuals, however, even where they do collect information on legal entities, credit history information is often less useful for the analysis of MSMEs, due to the above-mentioned reasons.

- Official financial accounts often do not reflect the actual economic situation of a specific MSME due to aggressive tax optimization strategies and other reasons.

- Real estate and other fixed assets that are part of a business are often owned by other related parties or by individuals. These entities may be legal owners, while the person who actually controls the asset is not indicated in any official documentation.

To compensate for the aforementioned characteristics of MSMEs in emerging markets, leasing companies need to develop other metrics using various variables to determine the credit ratings of their MSME clients. These variables should be easy to measure and relatively easy to document in order to support the goal of quick decision making that can, ultimately, be verified by internal audit and/or management. The easiest variable to document is the ownership of assets that are required by law to be registered or licensed. This includes cars, trucks, construction equipment, and other similar equipment.

The second variable that can be documented (formally or informally) is the company's revenue figure. In general, even if revenue is frequently underreported, certain assumptions or corrections may be made to the reported figures. In addition, most entrepreneurs maintain management accounts where a complete picture of income can be seen.

The third variable that can be measured in some countries is the credit and legal history of an individual or MSME.

Thus, the creation of an internal scoring model or segmentation matrix begins with these three variables.

Models

In order to demonstrate how a model could be developed, we can start with some examples:

Customer A: prospective Customer A applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer A already has 10 similar Volvo trucks and a monthly turnover of USD 40,000. Customer A has some history of obtaining SME loans, no problems were reported to credit bureaus and a review of legal databases does not show that Customer A has ever been sued for non-payment by a bank or leasing company.

Customer A will receive a high internal credit rating, which we will set at '5'.

Customer B: potential Customer B is applying for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer B has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 3,000. Customer B has a long track record of obtaining SME loans, no problems were reported to credit bureaus, and a review of legal databases does not show that Customer B has ever been sued for non-payment by a bank or leasing company.

Customer B will receive a low internal credit rating, which we will set as a “1” or “2” score. The upgrade to "2" could be due to credit history.

Customer C: prospective Customer C applies for a USD 125,000 Volvo truck lease. After a 20% advance payment, the monthly payment for 3 years at 20% per annum will be approximately USD 3,700-3,800 per month.

Customer C has one delivery truck built in Russia with a market value of USD 20,000 and a monthly turnover of USD 2,000. Customer C has a long history of obtaining loans from banks. Problems with other banks were reported and Customer C was sued for non-payment.

Customer C will receive an unsatisfactory internal credit score, which we will set as a '0' score.

Terms and Conditions for Each Rating

Intuitively, financing the requested transaction for Customer A should only include proof of company income, ownership / registration documents for the ten trucks, and a review of the legal databases. That’s it, nothing more!

For Customer B, the rating of the proposed transaction looks weak, but nevertheless, this is a client that the leasing company would like to finance. Therefore, to mitigate the risk, the client may be required to make a substantial advance payment, say 50%, to bring the monthly payment down to around USD 2,300. Or he/she could be persuaded to buy a less expensive truck.

Customer C will be denied funding due to his/her credit history. However, if Customer C would find a guarantor with good credit ratings, he/she could potentially get funding for a low-cost Russian truck with a 40-50% advance payment.

Developing the Model

The examples above show the extremes of potential ratings or segmentation models. Individual leasing companies and professionals would then have to determine the indicators of the above variables (i.e.> 10 similar trucks is "very good",> 5 but <10 is "good", similarly, if the monthly revenue is > 10x the monthly rental payment, this is “very good”), in order to determine what variables or indicators would be necessary to assign scores between 1 and 5. Similarly, once the credit score parameters have been determined, the company will determine what advance payment levels, interest rates and lease terms are available for each credit rating level.

Asset Risk

The main factor that impacts asset risk is liquidity.

Key liquidity comparisons:

- Low value assets are generally more liquid than high value assets (for similar assets).

- New assets are more liquid than older ones, even though they may be more expensive.

- Vehicles are usually more liquid than equipment.

It is important for leasing companies to understand the dynamics of market values and residual asset values over time. This is especially important if a more aggressive credit risk policy is required in order to be competitive. It is important to develop internal residual value curves in order to correctly assess the ratio of the market value of the leased asset to the outstanding principal of the respective lease agreement.

To gain a competitive advantage, increase margins and add value to partnerships. Knowledge of assets allows the leasing company to take on additional credit risk, finance riskier clients, and generate higher risk-adjusted returns.

Supplier Risk

While banks and new entrants to the leasing industry often pay too much attention to customers' credit risk, they often overlook the risk associated with the supplier of the leased item. It is important to remember that this “hidden” risk is potentially much greater than the customer's credit risk (based on a single transaction). After all, the supplier gets the cash from the transaction!

Specific aspects of credit or performance / delivery risk associated with suppliers are as follows:

- Does the supplier own the asset that you plan to acquire?

- Do they have tax arrears or other debts?

- What is their situation regarding VAT?

The worst-case scenario for a leasing company is that it agrees to buy equipment from a supplier, this supplier does not own the equipment at the time of purchase but plans to buy it from a third party. If the leasing company transfers money to the supplier and the latter has a tax debt that results in the forfeiture of the account, then the leasing company has an unsecured claim on the supplier and the property that the leasing company planned to buy is still in the possession of the original owner.

To mitigate or manage these risks, financial institutions and leasing companies are encouraged to:

- Work only with authorised dealers (if possible).

- Conduct appropriate due diligence, including site visits and supplier credit analysis, especially with respect to tax arrears.

- Verify ownership of assets and understand shipping and delivery terms;

- If unacceptable risks are identified, the leasing company may require that title to the leased asset be transferred prior to payment, including taking physical ownership/possession of the asset by the leasing company or the lessee client.

Management of Lease Contracts

One of the key issues when considering developing a leasing company focused on MSMEs is potential investment in software and information management technologies.

Basically, two key software components need to be addressed:

Accounting

In general, all countries have accounting software that is appropriate for managing the accounting of leasing operations. The complexity and standardisation required are quite low. Therefore, this is usually not a serious obstacle to the development of the leasing business.

«Middle Office»/Contract Management

In addition to the accounting software, leasing companies generally need software to manage their lease agreements. The first question should be: is there a national solution that integrates easily with local accounting software? This is often the most difficult area for new entrants.

It is important to remember that any software that supports the operations of a business must be tailored to the operations, processes, and procedures of a particular company. It is not recommended to buy off-the-shelf software, especially if it is software developed overseas, without a good understanding of its underlying logic. In the absence of a local solution that can be easily integrated with the accounting software, keep in mind that Excel (if you can find a VBA developer) can be used to manage up to 500-1,000 transactions. In the case of more than that, it may no longer work effectively. Regardless of what IT solution is chosen, it must be flexible and you must have your own programming team.

Keys to Success: Speed and the ability to react to market changes are keys to success. This requires constant adjustments to risk parameters and products. This becomes impossible if a company implements an inflexible off-the-shelf product that cannot be updated to match market changes.

Other non-IT Issues

As the owner of the leased asset, lessors should be aware of the following issues:

- Special registration and taxation requirements that arise due to their ownership of the leased assets.

- Traffic fines (for vehicles) and related fees.

- Liability for negligence.

- Responsibility for “choosing” the leased asset: does your leasing legislation protect the lessor? In a number of countries, leasing legislation directly assigns responsibility to the lessee for the choice of the leased asset and the supplier.

In addition to the legal advice required to properly assign the responsibility for the choice of the leased asset and the supplier, legal advice and analysis is required to determine potential liability issues and recourse that a leasing company may have in the event that its property (i.e. the leased asset) is involved in the administrative or criminal violation of local laws. This includes setting up procedures to properly administer, pay and collect on traffic fines and other similar violations.

Collection – Repossession - Resale

As noted in this paper, MSME leasing companies must find a way to assume more aggressive credit risks than banks. Consequently, if you are taking on more credit risk than a bank, you should prepare for less strict payment discipline and you must have policies and procedures in place for collecting potential arrears.

In the event of a delay in payment from your customers, it is important to respond quickly and efficiently:

- Your property (i.e. the leased asset) is often the main source of income for MSMEs. It is your collection team's job to continually reinforce this fact. If the asset is repossessed by you (the lessor), the customer loses a key asset and all income associated with it.

- If you do not position yourself as the main creditor, the client will pay others before he/she/it pays you.

- If you do not demand due money in a timely and consistent manner, some of your clients will not pay (on time).

Repossession and Resale: Minimising Losses

Speed and efficiency are important when dealing with arrears. Assets depreciate at a rate of 1-3% per month, and even faster when they are in the hands of someone who stops servicing them. Borrowing costs are another +/- 1% per month. This is why, after six months of accrued arrears, you can already assume that you have lost about 15-25% of the value of your investment.

Repossession of leased assets is a unique business process, which requires attention, training and specialists. It is difficult to outsource this activity as the circumstances of the individual arrear and the types of leased assets can be very different.

We encourage you to develop relationships with equipment dealers who can help you efficiently store and resell seized assets. It is also recommended to develop internal expertise in asset valuation. This helps reduce transaction processing times during the contract preparation process and facilitates faster decision-making when selling seized assets.

Conclusion

Never forget these two main characteristics of MSME leasing:

- This segment can be subject to significant competition from banks; and

- The value of each transaction is relatively small.

Therefore, all management and strategic decisions should be made taking into account the following principles: speed and efficiency.

Supplier relationships are an important marketing tool that leasing companies should develop as they value the non-price characteristics of your services. In addition, suppliers value quick decision making and your asset knowledge.

To bankers: it may look like a loan and feel like a loan … but It is not a loan! For a leasing product to be successful, it needs (i) its own marketing strategy and (ii) its own specific approach to risk management that fully reflects the relatively solid collateral provided by the lessor’s ownership rights.