Introduction

Vendor finance schemes provide an opportunity for financial institutions to deliver a unique product offering and to be more competitive in the SME financing market through the establishment of formal cooperation with equipment vendors looking to increase revenue.

SMEs typically acquire relevant productive assets (e.g., machinery or equipment) using one of three methods:

- funding from their own resources (e.g., company liquidity)

- financing from the equipment vendor

- financing received from a financial institution

Each of these methods has advantages and disadvantages for each party. However, the cost-benefit analysis for each party may be significantly adapted and made more desirable through the establishment of formal co-operation between financial institutions and vendors - so called “vendor finance schemes”.

Although a variety of vendor finance schemes exist, this document describes in detail two categories of schemes in which a financial institution and vendor formally co-operate: vendor subsidy schemes and buyback schemes.

In order to first provide a theoretical foundation, the document starts by describing the two traditional asset financing approaches (i.e., asset financing from the vendor or from a financial institution), highlighting the costs and benefits of these two approaches.

Following this, the benefits and drawbacks of the two vendor finance schemes (i.e., vendor subsidy schemes and buyback schemes) are detailed and compared with traditional financing approaches. Key considerations for the successful implementation of the vendor finance schemes are also highlighted.

Traditional asset finance approaches

In cases where SMEs (“buyers”) require finance to purchase new machinery or equipment, asset finance is typically supplied by equipment suppliers (“vendors”) or financial institutions (“FIs”).

Asset financing from the vendor

While vendors of equipment naturally prefer receiving cash upfront for their sales, bigger-ticket equipment or machinery often represents a significant investment on the part of the buyer. The acquisition of such equipment may be a challenge for the liquidity of the buyer—sometimes resulting in lost sales for the vendor if the buyer cannot afford the equipment upfront and does not have financing options.

While vendors of equipment naturally prefer receiving cash upfront for their sales, bigger-ticket equipment or machinery often represents a significant investment on the part of the buyer. The acquisition of such equipment may be a challenge for the liquidity of the buyer—sometimes resulting in lost sales for the vendor if the buyer cannot afford the equipment upfront and does not have financing options.

As a result, in the traditional vendor asset finance approach, the buyer is offered credit by the vendor, sometimes after paying a certain percentage of the transaction amount as a down payment. The amount and terms of this credit may vary significantly, depending on the vendor, the nature of the client, the liquidity situations of both, previous business between the two, etc. In many markets, vendor financing may be referred to as “commodity credit” and may be very standardised or limited.

Given that vendors are typically more focused on sales rather than on financing, vendors often face challenges in managing credit portfolios of any significant scale. Additionally, the loss of an upfront cash payment from buyers may result in liquidity issues for vendors if done on a large scale. Therefore, many technology/equipment vendors find this vendor financing approach challenging or risky to employ on a significant scale, particularly those selling larger ticket technologies or equipment. As a result, many buyers may not have access to the type of financing they would need or prefer.

This financing approach does not (necessarily) involve a financial institution and has several advantages and disadvantages for both vendor and buyer.

|

PROS |

CONS |

|

|---|---|---|

|

Vendor |

|

|

|

Buyer |

|

|

Asset financing from a financial institution

Many SMEs seek asset financing from financial institutions (FIs) to acquire needed equipment. In the traditional FI financing approach, FIs provide finance to buyers to acquire equipment, with funds often disbursed directly to the vendor.

Many SMEs seek asset financing from financial institutions (FIs) to acquire needed equipment. In the traditional FI financing approach, FIs provide finance to buyers to acquire equipment, with funds often disbursed directly to the vendor.

FIs typically conduct a credit analysis of the buyer’s business and take the acquired asset (equipment) as collateral for the loan. A key characteristic of the traditional FI financing approach is the lack of strong cooperation between the FI and vendor.

As FIs are in the “business of credit”, they are well positioned to provide necessary finance to buyers. However, receiving financing from FIs may take some time, and FIs may be hesitant to take equipment as collateral due to difficulties in assessing resale value (and a limited ability to resell such equipment).

|

PROS |

CONS |

|

|---|---|---|

|

Vendor |

|

|

|

FI |

|

|

|

Buyer |

|

|

Vendor finance approach #1: vendor subsidy schemes

Overview

In order to boost sales of certain equipment, the vendor agrees to pay a subsidy to the FI, thus discounting the cost of lending and enabling the FI to offer preferential financing conditions to buyers seeking to purchase selected equipment and machinery from the vendor (e.g., the FI offers an interest-free or lower interest rate loan).

In order to boost sales of certain equipment, the vendor agrees to pay a subsidy to the FI, thus discounting the cost of lending and enabling the FI to offer preferential financing conditions to buyers seeking to purchase selected equipment and machinery from the vendor (e.g., the FI offers an interest-free or lower interest rate loan).

The subsidy provided by the vendor may be in the form of an upfront discount to the FI, or paid over time as an interest rate subsidy (i.e., paid as the SME buyer repays).

From another perspective, the vendor essentially pays a subsidy to the FI to provide preferential lending conditions to a buyer for the purchase of certain equipment.

Advantages and disadvantages of approach for each party

This approach is similar to the FI financing approach, but the coordination between the vendor and FI changes the cost-benefit analysis for each party.

Provided the needed equipment is covered under the scheme, the buyer gains from receiving discounted financing at no additional cost. The buyer may also benefit from the signalling effect that the FI is choosing to cooperate formally with the vendor in vetting potential vendors, reducing information asymmetries and vendor selection costs (the FI de facto provides a “seal of approval”). Buyers may choose to buy higher quality or more efficient equipment as a result of the discount.

The financial institution gains a competitive advantage by being able to provide preferential financing to the buyer at no significant additional financial cost (due to the subsidy received from the vendor). The formal cooperation with the vendor may also result in clients being referred to the FI, expansion into a new sector, or opportunities for joint marketing—all expanding the FI client base. The primary cost to the FI comes from the time and effort required to establish and negotiate a formal partnership with a vendor. There is not necessarily any increase in credit risk as the FI underwrites and approves credit similarly to the traditional FI financing approach.

|

PROS |

CONS |

|

|

Vendor |

|

|

|

Buyer |

|

|

|

SME |

|

|

The primary cost of the approach is borne by the vendor, who must pay the subsidy to the FI upfront or over time. The vendor presumably does this with the goal of increasing sales and winning new buyers. The cooperation with the FI makes the vendor more competitive and encourages buyers with less liquidity to avail themselves of FI financing, also reducing the need for the vendor to provide credit itself. Note that the vendor must also go through the process of negotiating and establishing a formal partnership with the FI. However, going through this process may also provide some benefits in terms of better financing terms from the FI to the vendor.

Key considerations

The successful implementation of a vendor subsidy scheme is particularly dependent on the following three aspects, which should all be considered in detail prior to the implementation of such a scheme.

The FI and vendor must negotiate and come to a detailed agreement that covers all particulars of the vendor subsidy scheme. The agreement should include, but not be limited to:

- a description of the scheme as well as the respective procedures and process flows

- a clear definition of specific equipment and machinery eligible for financing under the scheme

- mutual obligations and responsibilities of both parties

- a timetable for cooperation, including the validity of the subsidy

- financial and promotional obligations of both parties (including the amount of subsidy)

The equipment and machinery to be covered by the subsidy need to be clearly defined, with clear definitions as to what may be included (e.g., parts, maintenance, warranties, options, etc.) The vendor may benefit from limiting the number of products promoted by the subsidy.

Both the FI and vendor need to promote and announce the preferential financing options among their own target groups using specific marketing approaches. Coordination should be established to ensure consistent messaging and a targeted approach to potential clients.

Vendor finance approach #2: buyback schemes

Under the scheme, in order to meet the needs of buyers of its equipment, the vendor agrees to a buyback agreement, i.e., the vendor agrees to repurchase the equipment at a stated price within a specified period of time if the buyer defaults.

The buyback agreement serves as a guarantee to the FI, as the vendor guarantees that it will pay back the buyer’s obligation to the FI, covering the risk of default and thus enabling the FI to provide preferential loan conditions to the SME buyer. The reduction of credit risk resulting from the replacement of the SME buyer’s credit risk with the vendor’s credit risk enables preferential conditions. For example, the financial institution may provide a lower interest rate, a loan without collateral, or an expedited assessment and approval process. The exact specifications of the benefit must be negotiated and defined by the FI and vendor.

In order to enjoy preferential loan conditions, the buyer must make a down payment (typically at least 25% of the total sales price). The purpose of the down payment is to cover the vendor’s risk of having to re-sell the product, as well as to offset any possible depreciation and repair costs. The buyer’s financial participation through the down payment ensures that the buyer remains engaged in loan repayment.

The equipment title will stay with the vendor at the time of sale and until the buyer has repaid the loan to the FI, enabling the vendor to easily “buy back” the equipment if default occurs. Once the buyer has fully repaid the FI loan, the title is transferred from the vendor to the client and the buyback arrangement ceases.

In order to reduce the risk of the buyer damaging the equipment or engaging in inappropriate maintenance or repair, in situations where equipment insurance in unavailable or not feasible, a maintenance agreement is often included in the sale and a maintenance fee to the vendor is included in the cost of the loan from the FI (thus increasing the total transaction amount). This fee covers the cost of equipment repair and maintenance over the lifetime of the loan (while the vendor retains the title)—and represents additional revenue for the vendor.

Advantages and disadvantages of approach for each party

Provided the needed equipment is covered under the cooperation scheme, the SME buyer gains from receiving preferential financing. However, in order to take advantage of this, the buyer must make a down payment upfront and be willing to accept that the transaction amount will include a maintenance fee. Additionally, the buyer will also only receive the actual ownership title from the vendor once the loan has been repaid to the FI.

|

PROS |

CONS |

|

|

Vendor |

|

|

|

Buyer |

|

|

|

SME |

|

|

The financial institution gains a competitive advantage by being able to provide preferential financing to the buyer at no significant additional financial cost (due to the buyback guarantee provided by the vendor). Additionally, the buyer’s credit risk is largely substituted by the risk of the vendor making good on its buyback guarantee, which may reduce credit risk to the bank.[1]

It is hoped that the formal cooperation with the vendor will also result in client referrals, expansion into a new sector, and/or opportunities for joint marketing—all expanding the client base.

The primary cost to the FI comes from the time and effort needed to analyse and assess the vendor, establish and negotiate a formal partnership with the vendor, which must be carefully negotiated to ensure “default” and “buyback” conditions are unambiguous. Analyzing vendors before engaging in cooperation schemes is important to ensure that vendors are able to buy back equipment if and when needed.

The primary cost of the approach is borne by the vendor, who takes on the risk of having to buy back used equipment from the buyer in case of default. While the maintenance agreement helps to mitigate the risk that the equipment is impaired, the vendor bears the risk that reselling the equipment proves difficult or impossible. As a result, care must be taken to ensure the equipment identified for the scheme can be uninstalled and repossessed relatively easily, the liquid market resale value of the equipment is relatively stable, the vendor has experience in reselling such used equipment, and auxiliary costs (e.g., installation costs) are limited.

The vendor provides the buyback guarantee with the goals of increasing sales and winning new buyers. The cooperation with the FI makes the vendor more competitive and encourages buyers with less liquidity to avail themselves of bank financing. The buyback guarantee approach also reduces the need for the vendor to provide credit directly to buyers.

Key considerations

The successful implementation of a buyback agreement scheme is particularly dependent on the following aspects, which should all be considered in detail prior to the implementation of such a scheme.FI and vendor

The FI and vendor must negotiate and come to a detailed formal agreement that covers all particulars of the buyback agreement scheme. The agreement should include, but not be limited to:

- a description of the buyback agreement as well as the respective procedures and process flow

- a clear definition of what constitutes a “default” and what triggers a “buyback”

- a clear definition of specific equipment eligible for inclusion under the specific scheme

- mutual obligations and responsibilities of both parties

- a timetable for cooperation

- financial and promotional obligations of both parties

One of the most important preconditions for the success of a buyback agreement scheme is the vendor’s experience in selling second-hand equipment or machinery. The FI has to make sure that the vendor will be able to buy back respective equipment if and when needed. The equipment and machinery covered by the scheme must be clearly defined and limited to those items the vendor has experience with on the second-hand market. Additionally, clear explanations as to what may be included under the scheme must be considered (e.g., parts, maintenance, warranties, options, etc.)

Both the FI and vendor need to promote and announce the preferential loans covered by the buyback agreement among their own target groups using specific marketing approaches. Coordination should be established to ensure consistent messaging and a targeted approach to potential clients.

Due to a lack of experience in this area, insurance companies in many markets do not insure industrial equipment/machinery. The introduction of insurance could provide an alternative solution to the problem of the misuse and/or damage of purchased equipment. In cases where insurance in unavailable, the contractual obligation for potential buyers to seek service/maintenance only from the vendor and the inclusion of a service fee in the loan amount helps to reduce the risk of misuse or damage to the equipment. g down payment amounts

The down payment amount in a buyback scheme serves to assist the vendor in the case that equipment needs to be “bought back” (repossessed) and resold, assisting to cover repair and depreciation costs. The required down payment amount should be calibrated to ensure it is high enough to compensate the vendor for the risk equipment must quickly be “bought back” but also not too high as to make the offer unattractive to buyers, particularly those with liquidity challenges. As a result, the minimum down payment requirement should be carefully set based on buyer demand, market competition, equipment depreciation and resale value, loan amount and tenor, and the vendor’s experience in the second-hand market.

[1] Vendors, with which FIs have buyback agreements, are subject to monitoring and assessment in line with risk management policies of respective financial institutions.

Why is SME finance so challenging?

This article is based on a discussion paper compiled by Managing director of IPC, Dörte Weidig and published by CGAP (see http://www.cgap.org/comment/531#comment-531).

Although the discussion paper was published several years ago, the topic remains current. Matching external finance with the actual needs and capacities of small businesses was, is and most likely will continue to present a challenge. It remains a fact that inadequate financing – amounts, maturities, repayment schedules and security – can negatively affect not only actual repayment performance, but also the development of (small) businesses. Inadequate financing can lead to over-indebtedness and business failure. In other words, inadequate financing may actually contravene and undermine the actual goal underlying much of SME finance, i.e. to enhance small business development and strengthen the small business sector in an economy.

Three myths about SME finance

Small and medium enterprises (SMEs) are again at the center of attention of the international community. New international, regional and local initiatives aim at supporting and reinforcing SMEs as their crucial role in strengthening an economy has become obvious. At the same time, achievement of expected results and indicators as set forth both in earlier and current initiatives is still in question.

Unfortunately, the environments in which SMEs operate are not always conducive to their growth and development. This is true for many commonly cited factors, such as regulatory framework, fiscal treatment, qualification of personnel and, last but not least - access to finance.

Being at the center of attention for many years meant that SMEs received significant support in terms of business development services, policy dialogue, “political” empowerment and – not least - provision of funding for external financing of these businesses.

The results of several recent studies on SME demand for loans confirm what we, as consultants who have been working with SMEs for decades in many countries on four continents, have seen on the ground: access to finance is not always the main problem.

Our hands-on experience has revealed a number of mistaken assumptions about SME finance. I shall highlight three core myths about SME finance:

Myth #1:

“There is a huge financing gap for SMEs – more funds are needed to close this gap”

Myth #2:

“Commercial banks know how to finance SMEs”

Myth #3:

“In order to foster economic growth it is important to provide finance to SMEs, no matter how”

Despite the abundance of liquidity available to financial institutions in many parts of the world, only few SMEs have access to finance that allows for sustainable growth. Some are fortunate enough to operate in markets where liquidity flows in a way that enables them to obtain a share of it–-but at the risk of either receiving too little financing or becoming over-indebted, if creditors lack responsibility.

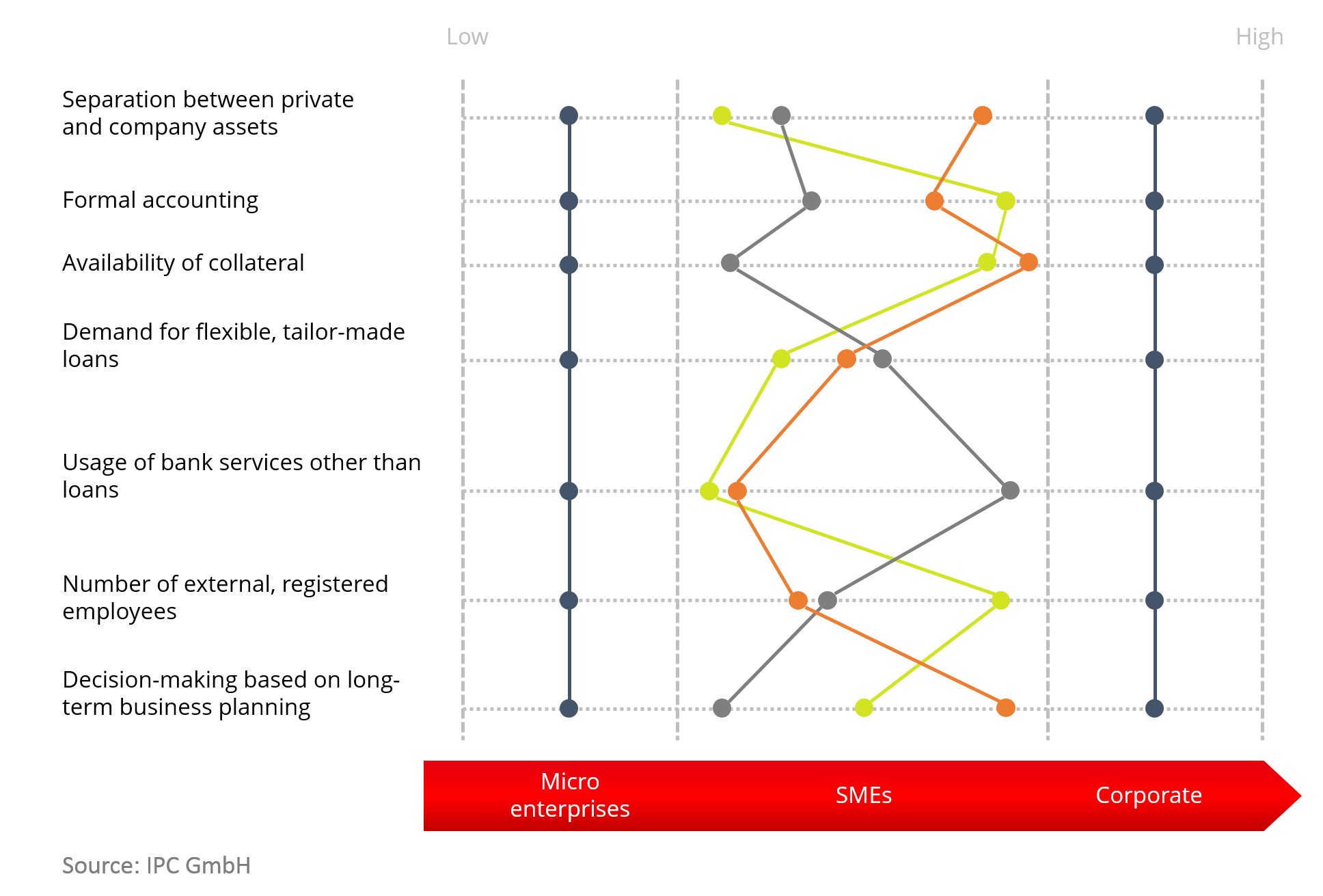

One issue that many financial institutions face when starting to develop SME lending is that this segment is extremely heterogeneous. While it is fairly easy to identify common features among micro enterprises and corporate businesses, it is far more difficult to classify SMEs.

Hence, a more suitable approach to customer service and risk assessment is needed to serve these businesses adequately and control credit risk. More than for any other client group, the principle of “Know Your Customer” applies. However, the lack of capacity or willingness of many financial institutions to invest in understanding the financial needs of SMEs has caused and will continue to cause more harm than good for both - SMEs and the financial institutions issuing loans.

To underline my arguments, I shall focus on the financial situation of two SMEs that illustrate the “myths about SME finance”. Although every situation has its own unique features, the descriptions presented below are by no means isolated cases, and my colleagues and I often encounter similar examples. They reflect some of the negative consequences that can result if financial institutions do not understand the client’s business (potential) and financial needs:

Scenario 1 - irresponsible financing

Business description

An entrepreneur produces plywood and wooden components for doors. The business was founded in 2001 by Mirlan and Assel K. and developed steadily until 2006. In 2007, driven by the economic upturn, production capacities were expanded, followed by a series of further investments in view of optimistic business projections. The enterprise has 28 employees. A column on the right side shows the SME’s actual financial statements as of January 2008 and June 2009.

Behind the scenes

As of June 2009, the business had 14 outstanding loans received from five different banks and one leasing company. Although the main business income is generated in local currency, all loans were disbursed in EUR and USD, which means that currency risks were completely ignored by the lending institutions. As a result, the client incurred over-indebtedness as investments in equipment exclusively financed by external borrowing denominated in foreign currency require a respective increase in sales volume and/or profitability. In fact, however, the client’s actual sales and profits dropped. The impact of the financial and economic crisis on the business just was the top of an iceberg.

Balance sheet, in USD

|

Item / Date |

01.01.2008 |

% |

01.06.2009 |

% |

|

Current assets |

481,233 |

41 |

402,105 |

26 |

|

Fixed assets |

701,011 |

59 |

1,126,983 |

74 |

|

BS total |

1,182,244 |

100 |

1,529,088 |

100 |

|

Short-term liabilities |

168,739 |

14 |

252,571 |

17 |

|

Long-term liabilities |

809,407 |

68 |

1.443,575 |

94 |

|

Owner's equity |

204,097 |

17 |

-167,058 |

-11 |

|

BS total |

1.182.244 |

100 |

1.529.088 |

100 |

Profit & Loss statement, in USD

|

Item / Date |

01.06.2008 – 31.12.2008 |

% |

01.01.2009 – 31.05.2009 |

% |

|

Sales revenue |

184,687 |

100 |

107,492 |

100 |

|

Gross income |

71,969 |

39 |

64,181 |

60 |

|

Disposable income |

47,605 |

26 |

-10,147 |

-9 |

|

Total installment on all loans |

32,124 |

17 |

32,124 |

30 |

This SME is currently facing many problems, but has no difficulties obtaining access to finance. Although SME lending is apparently booming in many markets worldwide, irresponsible lending practices, such as ignoring currency risks or a client’s over-indebtedness may cause more harm than good for SMEs in transitional and developing economies. Therefore, financial institutions need to understand the businesses of clients and provide adequate financing in order to foster growth of the SME segment.

Scenario 2 – inadequate financing

Business description

Emil A., an entrepreneur, imports and produces perfumes. He founded his business 18 years ago. He owns three stores, of which two are in the center of the city and one in a large shopping mall. To optimize his taxation, he transferred ownership of the stores to his niece and two nephews. He purchased one of the stores quite recently. Emil has a diploma in business administration. He is the sole director of his business and has six employees.

The tables on the right presents information available on his 2010 official and actual financial reports.

Behind the scenes

Emil financed the purchase of the last store and replenished his working capital by means of credit cards and short-term loans. At the time of the analysis, the enterprise had 8 credit card with limits and five short-term loans received from eight banks. The only long-term loan was for working capital, for a maturity of 2.5 years and with 6-month grace period. Emil received this loan from a bank where he has been a permanent client since 1992.

Баланс на 31.12.2010, в долл. США

|

Item / Date |

Official |

% |

Actual |

% |

|

Current assets |

56,493 |

83 |

56,493 |

16 |

|

Fixed assets |

11,791 |

17 |

307,211 |

84 |

|

BS total |

68,284 |

100 |

363,704 |

100 |

|

Short-term liabilities |

56,323 |

82 |

56,323 |

15 |

|

Long-term liabilities |

5,733 |

8 |

5,733 |

2 |

|

Owner's equity |

6,227 |

10 |

301,648 |

83 |

|

BS total |

68,284 |

100 |

363,704 |

100 |

Profit & Loss statement, 01.01.-31.12.2010, in USD (monthly average figures)

|

Item |

Official |

% |

Actual |

% |

|

Sales revenue |

9,254 |

100 |

21,469 |

100 |

|

Gross income |

2,684 |

29 |

9,661 |

45 |

|

Disposable income |

648 |

7 |

4,346 |

20 |

This SME enterprise also has no problems accessing finance, but the funding it receives is not adequate. Credit cards are an acceptable tool for purchases abroad, but they should not be used to finance permanent working capital needs, as maturities of these debts do not correspond to the operational cycle of the business and the cost of funding is unnecessarily high. A maturity mismatch in financing structure creates a high liquidity risk for all types of business.

What these examples show is that many financial institutions do not understand the needs of enterprises and have not yet recognised the real potential of SMEs. This is the only conceivable explanation as to why so few have “invested” in developing a sustainable capacity to serve SMEs in a responsible way and to the client’s satisfaction. Catering to real SME needs requires a substantial up-front effort and SME lending models developed for stable markets with reliable documentation cannot be applied to markets that are still largely informal.

Financial institutions that are genuinely interested in serving SMEs need more long-term support from donors and development finance institutions so that they can develop the capacities needed to serve SMEs on a sustainable basis. In other words, support that goes beyond funding and short-term advisory is necessary for real institution building.

Readers of this article may note that the arguments are shaped in a way to make a case for more consulting and technical assistance. Well, yes, this is partly true. Opponents may come up with different arguments – but engage in real discussions with some SMEs about their lending experience – and some of the above-mentioned popular beliefs will be quickly demystified.