In the context of the COVID-19 pandemic, the barriers that stood and stand in the way of development of women's entrepreneurship have aggravated and can harm the future of women's business even more.

In the context of the COVID-19 pandemic, the barriers that stood and stand in the way of development of women's entrepreneurship have aggravated and can harm the future of women's business even more.

Therefore, it is even more critical now to look at these barriers and find approaches and tools to mitigate the impact of the crisis on women and female business.

While assessing the past and looking into the future, numerous international institutions and think tanks argue that if women entrepreneurs played a more active role, huge benefits would be achieved in the global economy. Even before the crisis caused by restrictive measures to overcome COVID-19, an analysis by the Boston Consulting Group showed that if women and men participated equally as entrepreneurs, global GDP could rise by approximately 3% to 6%, boosting the global economy by $2.5 trillion to $5 trillion.[i] These are huge numbers! Now in a pandemic, the issue of economic growth goes by the wayside in many countries, while the issues of gender inequality have taken top lines on the agenda of many countries and economies.

Like most countries in the world, Central Asian countries have committed to support gender equality and women's economic empowerment.[ii] However, data analysis demonstrates that effective tools to expand economic opportunities for women have not been created so far: before the crisis, we could witness a sizeable gap in employment and renumeration, and limited financial inclusion of women in Central Asia, like in many other countries of the world.[iii]

Table 1 Women in labor force[iv]

|

|

Female population, % of total |

Percent of females in labor force, % |

Percent of firms with female top managers, %[v] |

|

Kazakhstan |

51.5 |

48.4 |

26.0 |

|

Kyrgyzstan |

50.5 |

38.4 |

32.9 |

|

Uzbekistan |

50.1 |

40.8 |

12.4 |

|

Tajikistan |

49.6 |

37.3 |

6.6 |

Female population accounts for 50% of total on average in Central Asian countries, with Kazakhstan having the largest share of women in labor force (48.4%). The percentage of women in top management roles shows that employers still give preference to men. The figures clearly show that women on their career path face the so-called "glass ceiling" and remain in lower-level positions, which results in lower female involvement in decision-making and representation in senior positions. This trend is partly due to discriminatory attitudes and stereotypical perceptions of women as leaders, as well as to natural selection, when men “choose their own kind.” Here we see the problem of disparity in employment and promotion, resulting in a high female representation in the informal sector of the economy[vi].

Even in times of no crisis, female mobility, career advancement and entrepreneurial success are limited due to time constraints that women fact because of household chores, caring for children and elderly relatives, which inhibits their growth, self-development and business development.[vii]

The circumstances described above impede the development of women's entrepreneurship in Central Asia. And, as a result, when women start their own business, they mainly invest in specific enterprises, which often have lower profitability levels than men's enterprises.[viii] Given all of the above factors, it is not difficult to conclude that the level of financial inclusion of women in business, too, is lower than that of men.[ix]

The all-encompassing wave of COVID-19 has had a negative impact on both female and male businesses.

According to forecasts, as a result of the virus-containment measure, the global economy will decrease dramatically by 3% in 2020, which is much worse than during the 2008-2009 financial crisis.[x]

According to forecasts, as a result of the virus-containment measure, the global economy will decrease dramatically by 3% in 2020, which is much worse than during the 2008-2009 financial crisis.[x]

The current crisis has an unprecedental impact on enterprises of all types and sizes around the world, and the countries of Central Asia are no exception. Many firms were forced to suspend or shut down their business. All over the world we are witnessing an increase in unemployment, which, in turn, leads to a drop in the consumption of goods and services (people have no payment capacity), and, as a result, is detrimental to the economic prospects of enterprises.

Businesses that continue operations face lower turnovers, lower profits, or even operate at a loss. In such an environment, many enterprises will increasingly encounter difficulties in servicing their obligations to financial partners (including financial organizations).

Micro, small and medium-sized enterprises (MSMEs) are particularly affected. On the one hand, it is easier for them to adapt, since they are usually more flexible (especially small and medium-sized enterprises when it comes to cost-cutting, finding new suppliers, new sources of profit, etc.). However, at the same time, they are especially vulnerable because they tend to have lower levels of productivity, fewer assets and more limited cash reserves they could rely on in a crisis. And then, such factors as the lack of necessary business and practical experience, a minimum of know-how, a low level of financial literacy, and limited access to finance, which negatively affect the growth and development of MSMEs even during crisis-free times.

For women who run a business, the situation is exacerbated by the traditional burden of caring for children and relatives (especially taking into account quarantine measures to close schools, kindergartens, and other institutions). And, as a result, women more than men come to the fore and / or factors such as an acute lack of time to take anti-crisis measures and conduct business are compounded. Considering that, compared to men's, women's business is often smaller and / or concentrated in low-profit areas, many women's enterprises which also have an additional burden may simply not have the knowledge, skills, time, financial capabilities to respond in a timely manner to the crisis and return to normal activities.

Response of the state, international and financial institutions

- Most Central Asian countries have developed specific economic measures to support entrepreneurship. Conditions have been created for businesses to increase liquidity, and access to credit lines has been streamlined. In addition, current loan repayment terms have been extended or suspended. Some banks and other financial institutions granted deferrals on loan repayments. Among other measures, the governments of the Central Asian countries have provided tax incentives and tax holidays to SMEs, postponed the deadlines for submitting tax return forms and tax payments, suspended tax audits or exempted most enterprises from social contributions. Social protection measures have been taken, subsidies and food baskets provided to the most vulnerable.

- Countries in Central Asia received emergency funding to mitigate the direct economic impact of the virus. For example, Kyrgyzstan was the first country to receive funds from the IMF in the amount of 120 million US dollars. In Tajikistan, the IMF approved an immediate write-off of the government debt, and the EU provided assistance in the amount of 48 million euros. The European Bank for Reconstruction and Development (EBRD) has proposed concessional financing measures for SMEs and emergency financing mechanisms to protect banks' liquidity for countries of presence. Many other international organizations that are present in the countries of the region have quickly reacted and reconfigured their technical assistance programs, focusing on combating the impact of the crisis on the population, enterprises and the economy as a whole.

To cope with the current crisis and its consequences, all MSMEs need support, and women in business especially need support, given the specifics of doing business and the circumstances that restrict activities even in stable economic conditions. Government organizations, international investors, and financial institutions can play an important role in overcoming the crisis.

Financial institutions, public and private companies to minimize the impact of the crisis on business (in particular, female business)

Financial institutions can adapt tools and approaches to assessing current business needs based on the current realities. Many experts talk about debt restructuring, additional business lending, etc. But such measures must be customer-oriented, economically feasible and competent, since a new loan or deferred repayment is not always the best solution for a business. The crisis leads to a further increase in high debt burden, and for many entrepreneurs, an increase in the debt burden can become economically disastrous.

Financial institutions can adapt tools and approaches to assessing current business needs based on the current realities. Many experts talk about debt restructuring, additional business lending, etc. But such measures must be customer-oriented, economically feasible and competent, since a new loan or deferred repayment is not always the best solution for a business. The crisis leads to a further increase in high debt burden, and for many entrepreneurs, an increase in the debt burden can become economically disastrous.- It is important to learn to make a quality assessment and analysis of the business situation and offer tailored and feasible, rather than standardized

- Design and implement subsidizing and financial support programs for businesses that had to suspend operations under the crisis impact. Especially, programs for women who are more exposed to the crisis and suffer more because of their traditional roles in the family.

- Initiate and establish discussion and information-exchange platforms, which is critical for any business, and, in particular, for women who, even under normal circumstances, have fewer business and social contacts for exchanging experience than men have. Such platforms will help to disseminate information faster about various business support measures to overcome the crisis, share ideas and know-how that will help overcome the impact of the pandemic.

- Conduct educational/informational programs and events for entrepreneurs and enterprises.

Such measures can be aimed at helping firms to forecast key indicators in the times of uncertainty, teach and help them to pivot their business, bring new services and products to the market. These can also be events on improving financial literacy or on more specialized topics, such as accounting, marketing, IT, etc. Given the specific barriers that women face, namely: lack of time for self-development and lack of knowledge and skills, initiate and create special training programs specifically for women to give them a boost and support in these difficult times. In the conditions of restrictions, they need advice, more than ever, in the field of business skills development, delegation of authority, and business management.

- Promote the development of special business support programs in the field of information technology. E-commerce is efficient and has many advantages during the crisis of overall distancing, and many businesses need to reconfigure their activities. For women, this turns out to be more difficult than for men, since they lag behind men in this area.[xi] Therefore, it is important to promote training in special skills for the MSME sector as a whole and at the same time to break female gender stereotypes in the field of IT.

- Develop infrastructure for the care of children, elderly and sick relatives.

- In a broader sense, it is necessary to create leadership support systems where men and women have equal rights and opportunities, before the next crisis breaks up. This can be done by equipping women with skills, training and opportunities to take leading positions, both at the head of enterprises and among business enterprises in which women are owners and managers, and by advocating for the changes that have been discussed in this article.

If both male and female businesses enjoy equal opportunities, and even the smallest companies are more competent, it will be easier for them to keep their business afloat, plan for the future, or even start a new business.

The conditions in which the world finds itself due to the SARS-CoV-2 virus give us the opportunity to implement changes that can protect the business from the most severe blows: going out of business today and in the future.

Everyone has a long and hard way to go. But this path can be fair if men and women have equal access to opportunities!

Additional sources of information:

[ii] https://eca.unwomen.org/en/news/stories/2015/09/30-countries-in-europe-and-central-asia-have-stepped-it-up.

[iii] The Global Gender Gap Report 2018, World Economic Forum (см. «List of Countries»)

[iv] The Global Economy.com serves researchers, https://www.theglobaleconomy.com/economies/

[v] World Bank, https://www.enterprisesurveys.org/en/data

[vi] Maltseva, Irina. (2007). Gender equality in the sphere of employment. Dushanbe: United Nations Development Fund for Women.

[vii] ILOSTAT, ILO Department of Statistics, 2020, https://ilostat.ilo.org [accessed 7 May 2020]; ILO: A quantum leap for gender equality: for a better future of work for all (Geneva, 2019). Before the crisis caused by COVID-19, every day 16.4 billion hours were spent on unpaid care work around the world, with more than two/thirds being performed by women.

[viii] Zbierowski, P. (2017). The Aspirations of New Technology-Based Firms in CEE and CIS Countries. Foresight and STI Governance, vol. 11, issue 3, pp. 50-60. Kazakhstan is an exception: women account for 52.1% of workforce in high-tech enterprises and for 49.1% - in low-tech enterprises. But for countries such as Kyrgyzstan, Uzbekistan and Tajikistan, low profitability and productivity of female businesses remains a real problem, due to the fact that most companies owned by women are small and employ fewer employees.

[ix] The World Bank, https://www.worldbank.org/en/topic/smefinance. Even before the crisis, according to the estimates of the World Bank experts, women-owned MSMEs around the world face a $ 1.7 trillion funding gap (of which 103 billion US dollars - in Central Asia and Europe).

[x] International Monetary Fund, World Economic Outlook Reports, World Economic Outlook, April 2020: The Great Lockdown, https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

[xi] According to the International Telecommunication Union, a UN agency, women use and have access to digital technologies less often than men (for example, in 2019 the share of women with access to the Internet was 48% vs 58% of men worldwide).

- Pictures designed by Freepik

Episode #1: Overview and concept

Episode #2: Foundations of portfolio analysis

Working Excel sheets for the episode: portfolio snapshot and historical portfolio

Episode #4: Stress testing for capital adequacy

Working Excel sheet for the episode: CAR

Episode #5: Stress testing for liquidity

Working Excel sheet for the episode: liquidity

Episode #1: Overview of portfolio risk management

Episode #2: Analysis of portfolio risk with KPIs

Episode #3: Vintage and migration analysis

Episode #4: Advanced topics in portfolio risk management

Some definitions

Segmentation refers to the process of grouping individuals – in our case clients/prospective clients - into groups (segments) with common needs, common behavioural patterns and similar reactions to marketing measures. The point is to identify groups that are homogenous as group or segment and respond in a similar manner to certain offers/situations, but are clearly distinguishable from other groups, their needs and their behavioural patterns.

Correspondingly, a client segment refers to a homogenous group of clients with similar needs and similar behavioral patterns.

The purpose of (client-) segmentation

The key reason for market- or client-segmentation rests in the fact that having identified such homogenous groups allows to better design products, sales channels, and marketing approach for respective groups. It also allows for more effective risk management. This allows to reach out to groups more efficiently and effectively.

- Improved focus: fine-tune products specifically to customer needs, target advertising and marketing and focus on most promising (profitable) subsets of clients

- Competitiveness and client retention: knowing who your customers are and what they want opens the door for pursuing them in a targeted manner and for optimizing pricing of products, tailoring products and services to specific subsets and, in this way, also enhance client loyalty

- Potential expansion: knowing your customers and potential customers, their needs and value for you allows you to expand your business with existing clients and to tap into new parts of the market most efficiently and effectively

- Pricing optimization: When you know the financial situation and social status of your clients as well as risk profile and costs on your side, you can optimize pricing to ensure that customers get the most value for their money and you generate maximum possible revenue

If we transfer this into the world of financial service provision, it means that it becomes possible to more adequately define and control risk by designing methodology, processes and procedures for specific parts of the market as well as designing products to fit better to the needs of specific types of clients. This also entails how best to set up operations in terms of organizational structure and personnel requirements, so that effective segmentation allows you to optimize how you do business in principle.

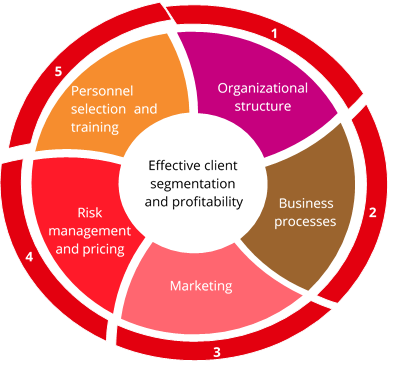

Graph 1: Effective client segmentation as basis for optimizing business

Ideally, client segmentation will result in an optimized strategy, organizational structure, staffing, business processes and product range as the entire approach, product offer, etc. can be tailored to fit the specifics of respective segments. In practice, this usually means trying to make processes, etc. as lean as possible (but as elaborate as necessary) for a respective segment, tailoring product parameters and conditions to meet the needs and possibilities of typical clients of a certain segment and designing your marketing approach and measures in a targeted manner.

Experience teaches, that many enterprises and financial institutions only start looking into segmentation when they start coming under pressure – be it to lower costs due to increasing salaries, continue to be viable in a market with decreasing margins due to increasing competition, etc. One outcome of this is that many businesses, including financial institutions, underestimate the need for collecting, storing and analysing data on clients. In a wide-open and profitable market, it just seems ‘unnecessary’, ‘a waste of time’ on s.th. no-one needs … This comes to haunt businesses and financial institutions later on.

Data used for segmentation

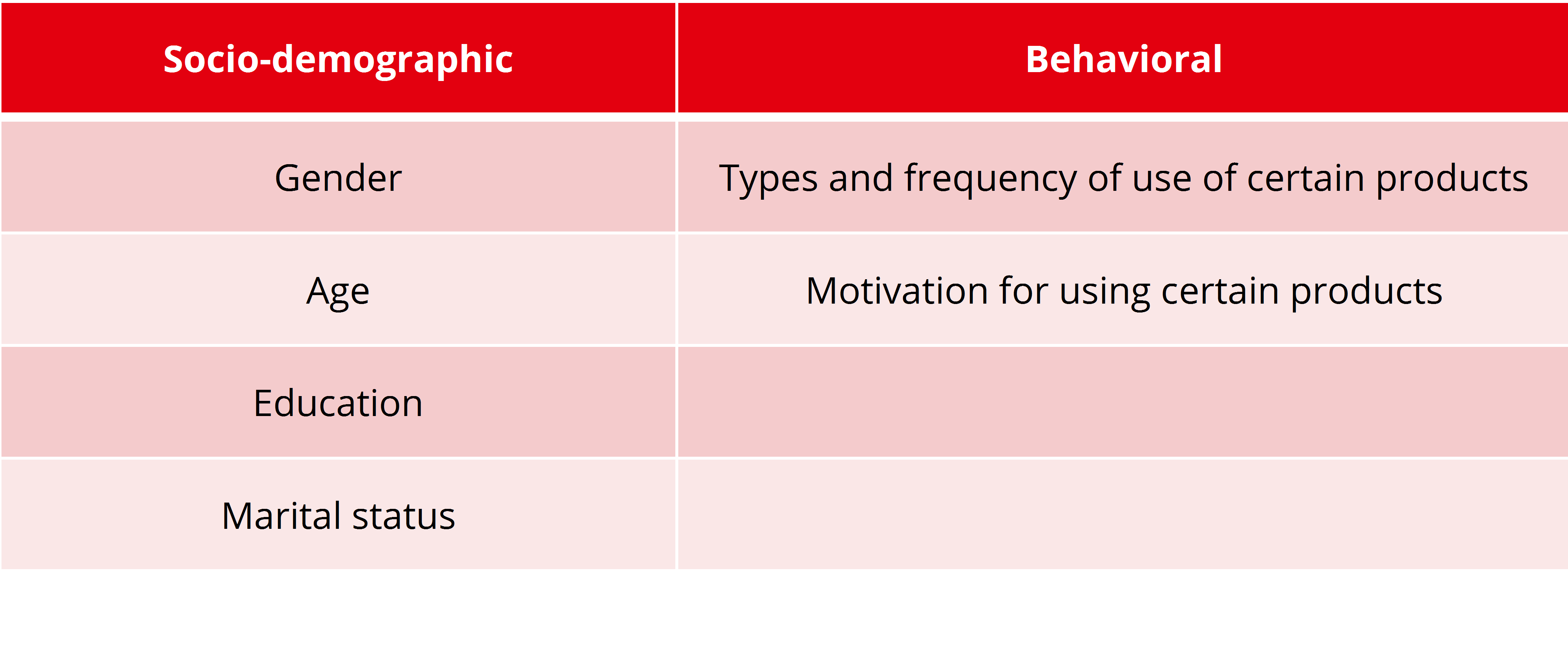

Below we summarize typical data used for segmentation:

- Socio-demographic information – e.g. gender, age, familial and marital status, income, education, social status, and occupation

- Geographical information – this could be country, region, city, town, county or city district a client resides at

- Psychographics – e.g. attitudes, lifestyle

- Behavioral data - e.g. spending and consumption habits, use of products/services or benefits the client is looking for in products/services

Segmentation approach

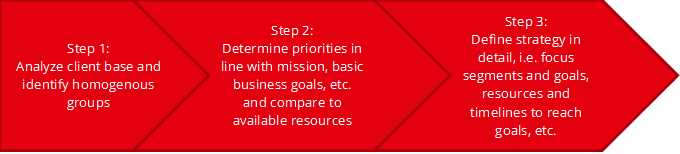

Usually, it takes three basic steps. The basis for meaningfully segmenting an existing or potential client base is information. Only if you have information on who is out there, how they behave, what they need, what they prefer and what they definitely do not need or want, can you start sorting clients into groups.

Based on this, you can then determine where your priorities are, which parts of the market, which clients are of interest to you (generate most value or have the potential for generating value) and what it would take to acquire, serve and retain these clients. You then compare this to your resources, your current set-up, available products, systems, personnel, etc., your strategic goals and plans. This then serves for determining your strategy.

Once you have decided your strategy, you can then go into details on how best to convert this strategy into concrete actions.

Graph 2: Using client segmentation as part of defining strategy

Instruments and data availability

Typical instruments used for analysing markets and client groups are quantitative and qualitative research. This usually takes the form of representative surveys and/or focus groups. Usually, there are professional companies which can assist with this work. In addition, financial institutions can also analyse their own portfolios – if data is available on client profiles, etc. In practice, however, it is exactly this lack of data availability which is a big issue at financial institutions. As indicated above, many financial institutions underestimate the importance of tracking and storing client information, so that, quite frequently, data of a sufficient quality and quantity is not available. Under these circumstances some segmentation is usually still possible but typically less exact, less detailed and, consequently, less useful than would be possible with better data. In any case, all segmentation needs regular review and fine-tuning over time as markets and clients, respectively, client needs and behaviour, may change over time. In any case, it is advisable for financial institutions to track and store client information as completely, correctly and in as much detail as reasonably possible.

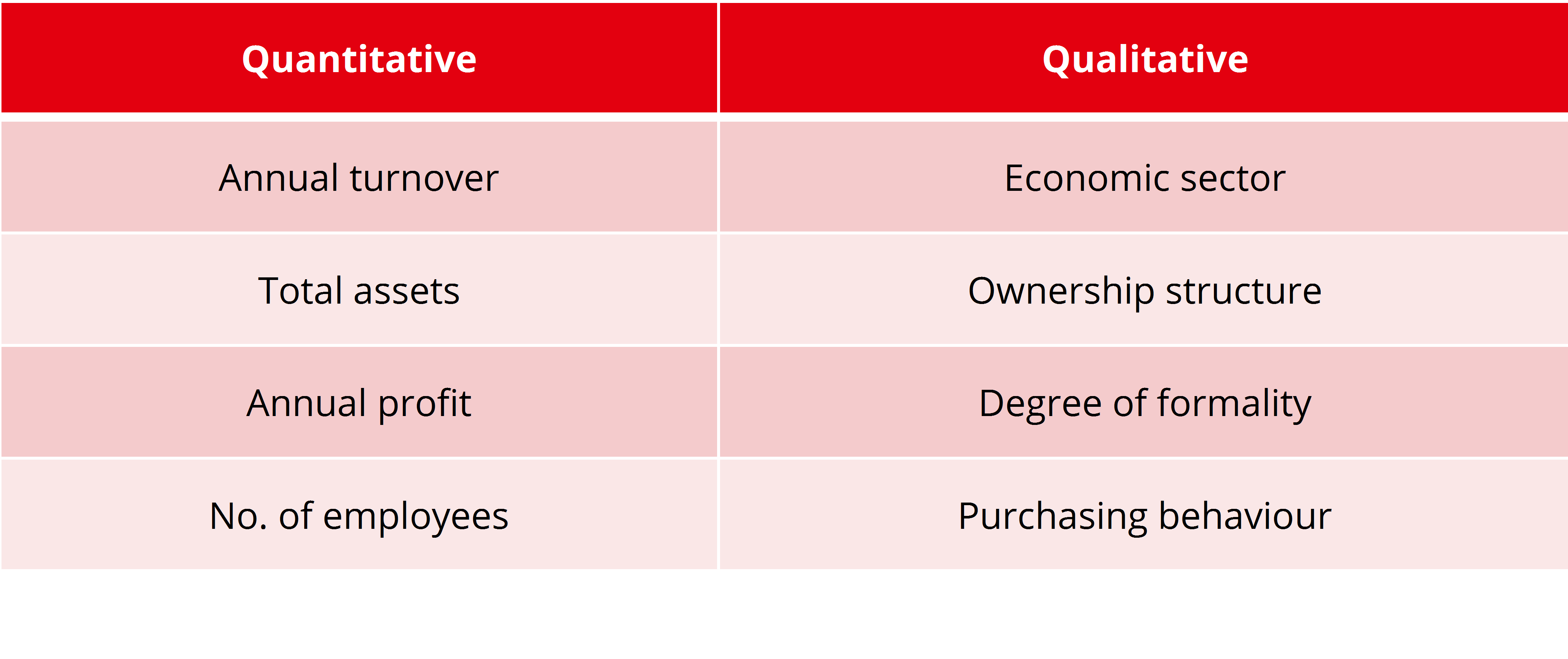

Data can be analysed quantitatively and qualitatively. Quantitative approaches typically include looking for clearly distinctive indicators to separate groups from one another and for indicators that help to put certain clients into the same group. In more technical terms, this involves looking for connections between data such as correlations between variables and probabilities that if indicator A applies, indicator B will also apply with a certain probability. Typical examples would be to look for a connection between annual turnover and loan amounts requested or annual turnover and annual profit. Please, note that this in itself says nothing about causality, all it says is that if A changes in a certain way then B is also likely to also change or be different.

Typical indicators used by FIs

When it comes to segmenting business clients, typical indicators used, can include:

Quantitative indicators can usually help at early stages to roughly separate existing client bases or break down a market, but usually just basic quantitative indicators are insufficient to arrive at meaningful segmentation. Take two businesses, for example, with the same annual turnover, the same profit and the same number of employees. However, the one business operates as limited liability company, whereas the other one is set up as sole proprietorship. Clearly, the risk profiles would be different or at least the documents and data you would need from these clients would differ.

Or, to provide another example, take two businesses with the same annual turnover, the same profit and the same number of employees. However, the one business is engaged in housing construction whereas the other is engaged in producing bread. Clearly, the risk profiles differ.

Therefore, usually additional indicators are used to segment clients. In addition to qualitative indicators related directly to the business itself, such as economic sector, ownership structure, etc. there are other factors influencing client behaviour or needs. These can include such indicators as:

In micro lending, for example, generally speaking, data indicates that women tend to be the better borrowers, i.e. more reliable in repaying loans on time than men.

In general, married men tend to be more settled and reliable in fulfilling obligations than bachelors. ‘Older’ people tend to be more responsible than ‘young’ people.

In insurance, for example, women and men often pay differently on car insurance (often there also are different rates for women and men drivers of different ages) as data shows that risk patterns differ depending on gender and age.

So, in short, by analysing your customer base and looking at how different aspects relate to one another you can get a better idea of who your customers are and what they would like to get from working with your institution.

Classification vs. segmentation

Segmentation should not be confused with arbitrary classifications done by governments or other institutions for statistical reasons or to determine eligibility for subsidies or special tax schemes. These classifications are usually quite arbitrarily decided, e.g. to be in line with the definition of other governments, and do not necessarily have their root in any kind of business logic. Consequently, they often are NOT suitable for the purposes of client segmentation.

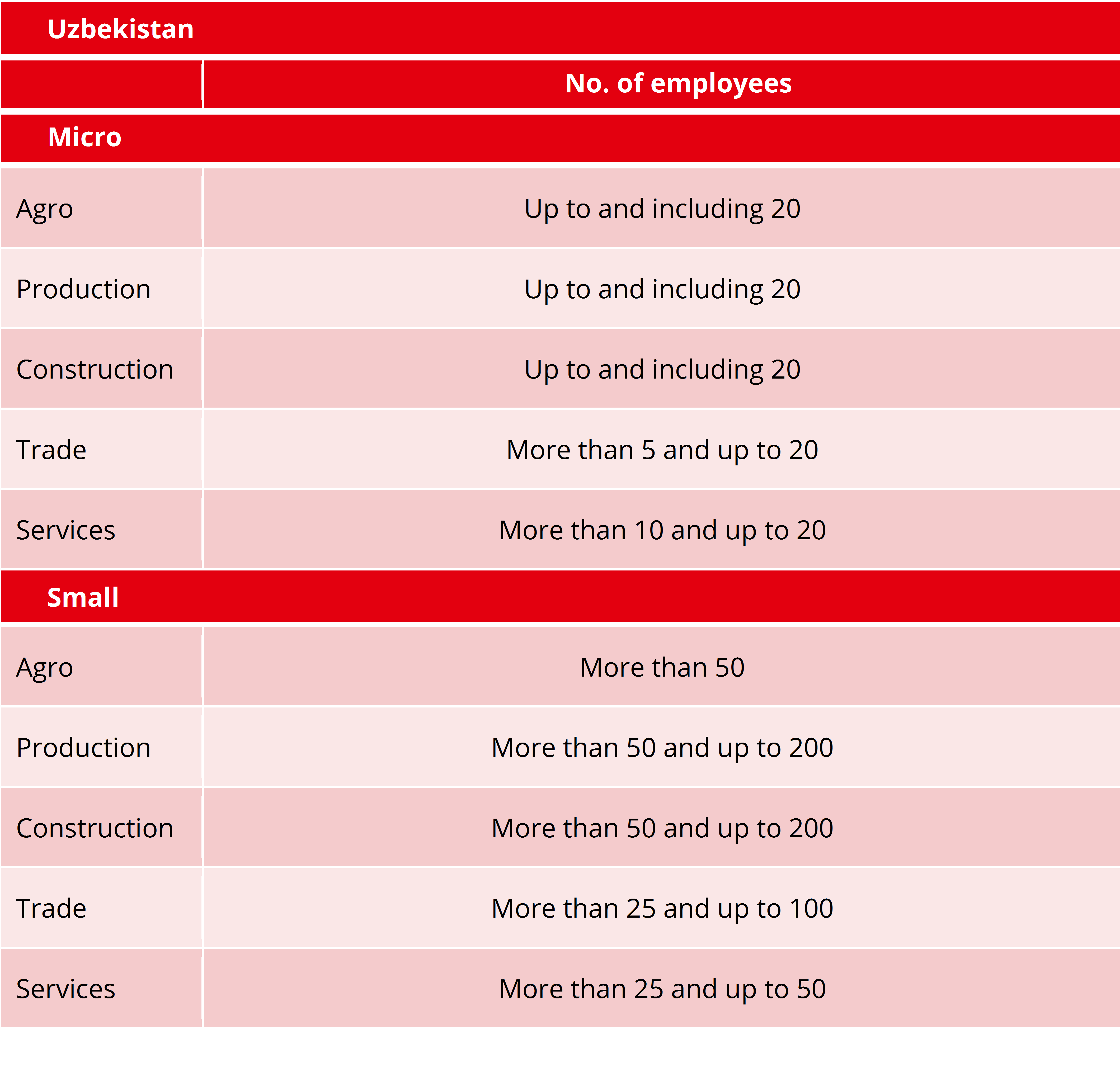

Table 1: Classification of micro-, small- and medium-sized enterprises in Uzbekistan

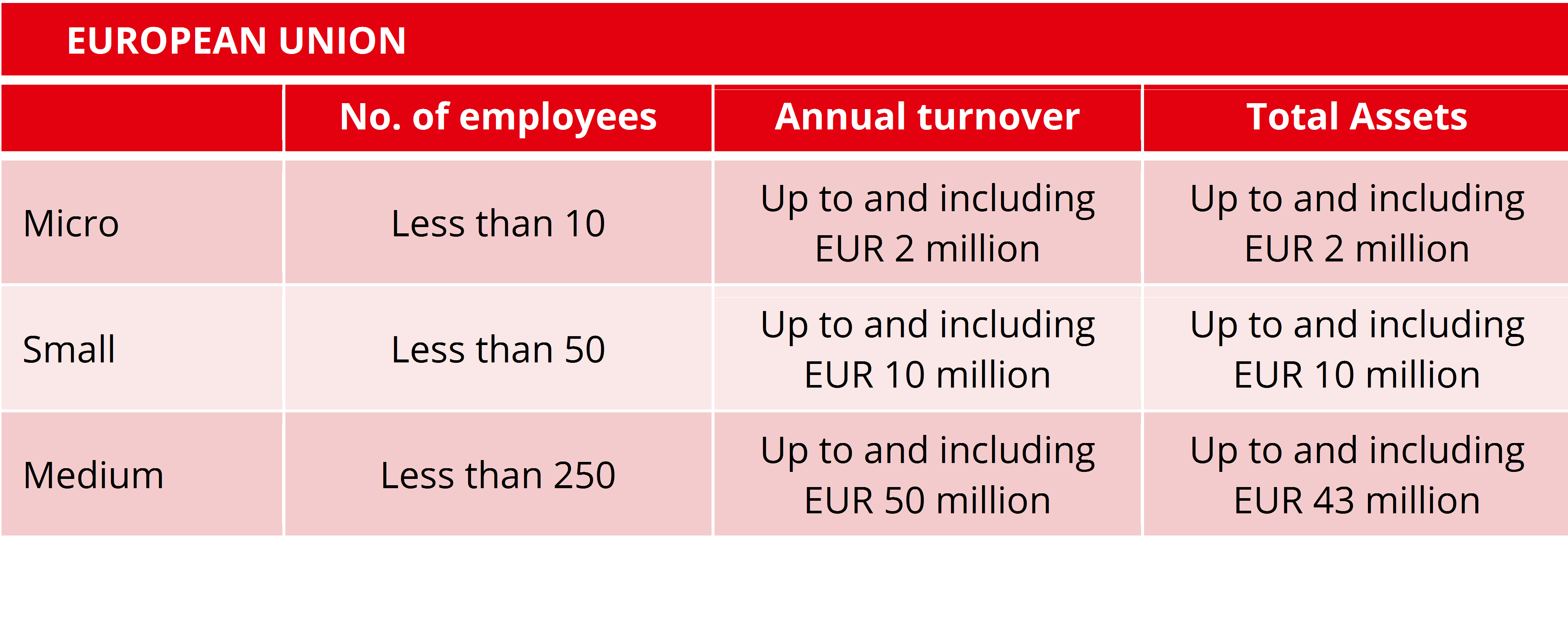

Table 2: Classification of micro-, small- and medium-sized enterprises in the European Union

Table 3: Classification of micro-, small- and medium-sized enterprises in the People’s Republic of China

HOWEVER, CAUTION: typical governmental classification approaches may use what look like the same indicators that you would use for segmentation, such as annual turnover, number of employees, total assets, etc. BUT the actual parameters (values) may be different and the context of how indicators and respective values were chosen is fundamentally different!

Getting your segmentation right

How do you know that your segmentation is working and effective? Very simple – you have succeeded in creating homogenous groups, i.e. groups of clients with a similar profile, similar needs, similar behavioural patterns and – as group - distinct from other groups. The approach and methodology you apply to the respective segment is working in that you are reaching the segment as planned, i.e. you are meeting planned business targets at planned resource investment.

Some final notes

Less is more and simple is usually good! The key is using the right indicators and values. While many, especially new business models, often advertise using a myriad of indicators, quantity in itself does not ensure quality.

Homogeneity allows for standardization and automation! The more homogenous a group, its behaviour and needs, the easier it becomes to focus processes, procedures, products, etc. and standardize them. The more standardized a process, etc. is, the easier it also becomes to automate at least parts of this process.

Segmentation itself requires regular review and adjustment! Just as with other aspects of providing financial services, segmenting clients is not a one-time-shot. Clients change, markets change, needs change, technical possibilities change. Against this background it is clear that current segmentation requires regular review and checking to see if the same indicators and values are still relevant. Another aspect of this is to also check on the emergence of new and more meaningful indicators, respectively, to identify possibly obsolete indicators.

Segmentation is part of a bigger whole! Segmentation serves to help you optimize how you operate your business in all its aspects, i.e. how to best set up operations, define personnel needs, processes, procedures, products, technical needs and infrastructure. It is not a goal or purpose in itself.